The Canadian dollar continued the momentum and recovered a lot of ground. Retail sales and Foreign Securities Purchases are the major events this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The loonie enjoyed a retracement of the US dollar after five consecutive weeks, and also the echoes of the superb jobs report from the previous Friday. Could we see a challenge of parity this month?

Updates: Foreign Securities Purchases sparkled, jumping to $13.34 billion. The estimate stood at $7.85 billion. Manufacturing Sales, a key indicator, declined 0.2%. This was well below the forecast of 0.7%. Wholesale Sales rose 0.3%, just under the estimate of 0.4%. USD/CAD has edged higher, and was trading at 1.0248.

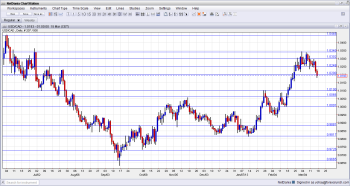

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Monday, 12:30. Non-residents decreased their holdings of Canadian securities by $1.9 billion in December, amid large retirements of bonds and equities. The reading was contrary to predictions for a 7.21 billion. Meanwhile, Canadian investment in foreign equities edged up to $2.5 billion in December, almost exclusively in a well-diversified basket of US shares. Foreign purchase are expected to reach $7.85 billion.

- Manufacturing Sales: Tuesday, 12:30. Canadian manufacturing sector ended 2012 with a negative release, registering 3.1% contraction, after a 1.8% gain in the previous month, indicating sluggish activity in the 4th quarter. Lower demand from the US together with a strong Canadian dollar were the main reasons for this decline. Economists expected a mild decline of 0.4% for that month. A gain of 0.5% is expected this time.

- Wholesale Sales: Tuesday, 12:30. Canadian wholesale trade contracted more than expected in December, falling 0.9% after a 0.7% gain in November. The drop was larger than the 0.4% fall predicted by analysts, indicating that Canadian economy contracted in December. The central bank admitted its growth forecast was too optimistic. A gain of 0.4% is predicted.

- Retail sales: Thursday, 12:30. Canadian retail sales dropped sharply in December, well below market predictions, amid weak reports from auto dealers. Retail sales plunged 2.1% to 38.62 billion Canadian dollars, the biggest decline since April 2010. The reading was also much lower than the 0.35 drop expected by economists. Excluding the automobile sector, retail sales weakened by 0.9%. In December, lower sales volume was reported in seven of the 11 sectors measured. Retail sales are expected to rise 0.6, while core retail sales are predicted to gain 0.4%.

* All times are GMT.

USD/CAD Technical Analysis

$/CAD started the week trading in a range between 1.0250 and 1.03. Late in the week, the pair made a convincing breakdown and even managed to close below 1.02.

Technical lines, from top to bottom:

1.0750 was the peak of ranges several times in the past few years, and is a very important line. 1.0660 was last seen in September 2011, but this line was also a long running swing high several times beforehand.

1.0523 was a peak back in November 2011 and is minor resistance. 1.0446 was the peak that the pair recorded in June 2012 and is a key line on the upside.

1.0340 was the peak during March 2013 and its position strengthens at the moment. The round number of 1.03 was resistance at the beginning of the year and now returns to this role. It worked perfectly well during June – over and over again, until finally being run through.

1.0250 was a peak before the pair moved below parity a long time ago, and worked as support quite well in March 2013. 1.02 was the trough of 2009 and remains important since then, working in both directions. These are the key lines for now.

Another round number, 1.01, was a trough back in July, and switched to resistance afterwards. The line proved its strength several times in 2013. 1.0066 was key support before parity. It’s strength during July 2012 was clearly seen and it gave a fight before surrendering. It has a stronger role after capping the pair during November 2012, but has begun weakening.

The very round number of USD/CAD parity is a clear line of course, and the battle was very clear to see at the beginning of August 2012 and also in 2013. It is a clear separator. 0.9950 provided some support for the pair during November and worked as resistance earlier.

0.9910 remains the chart after serving as a bottom border for the pair in November 2012. It already managed to work as weak resistance in December 2012. 0.9880 showed that it is a clear separator in October 2012. It also had a role in the past. This line switches roles once again.

0.9817 was a stubborn peak in September and is now significant support. As seen in December 2012, this line worked as a cushion. It worked very nicely in January 2013. Lower, 0.9725 worked as strong support back at the fall of 2011 and showed its strength once again in October 2012..

I am bearish on USD/CAD.

The Canadian dollar is likely to ride on the excellent jobs report despite the dovishness of the BOC. The reason is that the Fed is likely to weigh on the dollar and not provide any talk about an exit strategy to QE – perhaps only some very cautious optimism. The general direction for USD/CAD remains higher, but the pair could drop this week.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar.