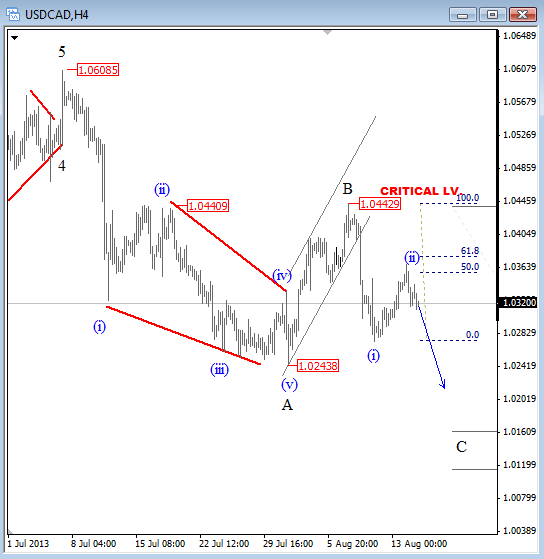

USDCAD reversed sharply to the downside at the end of the last week, clearly in an impulsive fashion, so the structure is now pointing to a weaker USDCAD if we consider that the rally from 1.0243 was made in three legs, called a correction.

We are talking about a wave B that has a high in place at 1.0442 from where we expect an impulsive extension down in wave C, back to 1.0243 and possibly even to 1.0150 in this week while 1.0442 is not breached. Recently, minor correction has stopped at 1.0350-1.0370 resistance zone from where weakness could resume.

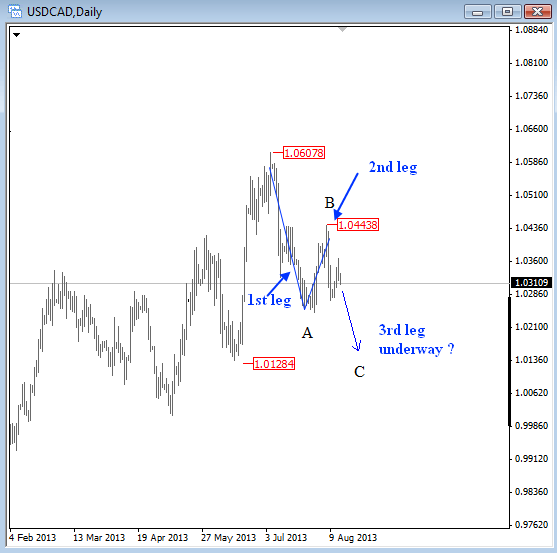

On a daily level we can see that prices have turned bearish maybe just temporary but in either case we need a minimum three legs down.

Why? Because that’s a minimum structure of a correction, called a zig-zag. So even if the larger trend is still up and if the current bearish waves are a small piece within a larger uptrend, the contra-trend movement still needs to be made by three sub-waves.