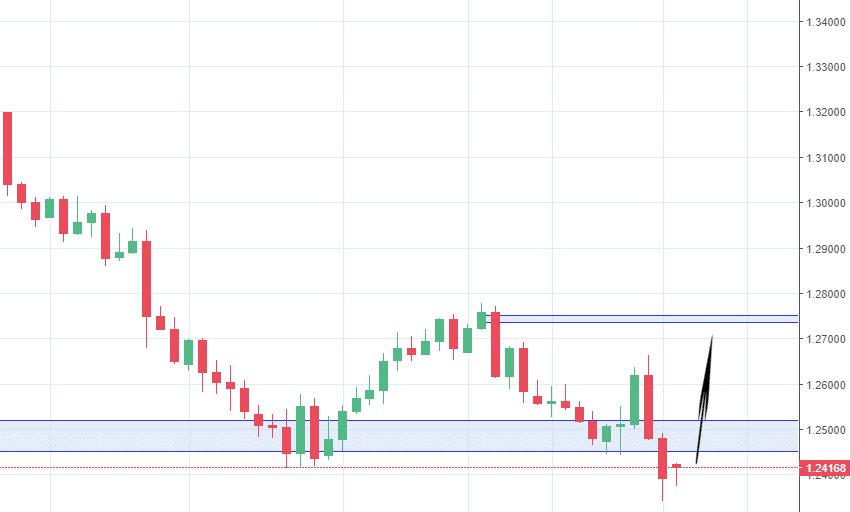

I am looking at the USDCAD pair. There are a few different factors that make me think it might be just before a turning point.

First things first. The Daily chart is showing price being hesitant and hitting a support level at the same time. It looks like we might see a bounce back to the 1.2700 level.

From a price action perspective, it looks like we might have an inside bar forming. I will wait for the end of day candle, but there is a high probability this could be the scenario.

From a weekly perspective, we have a multi-week support level on which price is currently residing. This implies that we might see a bounce-back from that perspective, too.

Another point to consider is the Canadian dollar ETF index- FXC. It is also standing on a major resistance level.

This gives another point of view and a confirmation that we might be onto something.

Conclusion:

All in all, it looks like USDCAD is standing on a major point. Whether it be a breakout from the current levels or a reversal, I am expecting to see a major move. If it reverses, I will be looking at the 1.2700 level initially. If it breaks out, I will be looking at the 1.2000 psychological level.

Guest post by Colibri Trader