- The USD/CHF could resume its upwards movement after making a new higher high

- The United States inflation data could bring fresh opportunities tomorrow

- The current drop could be only a temporary one, so we can still search for long opportunities

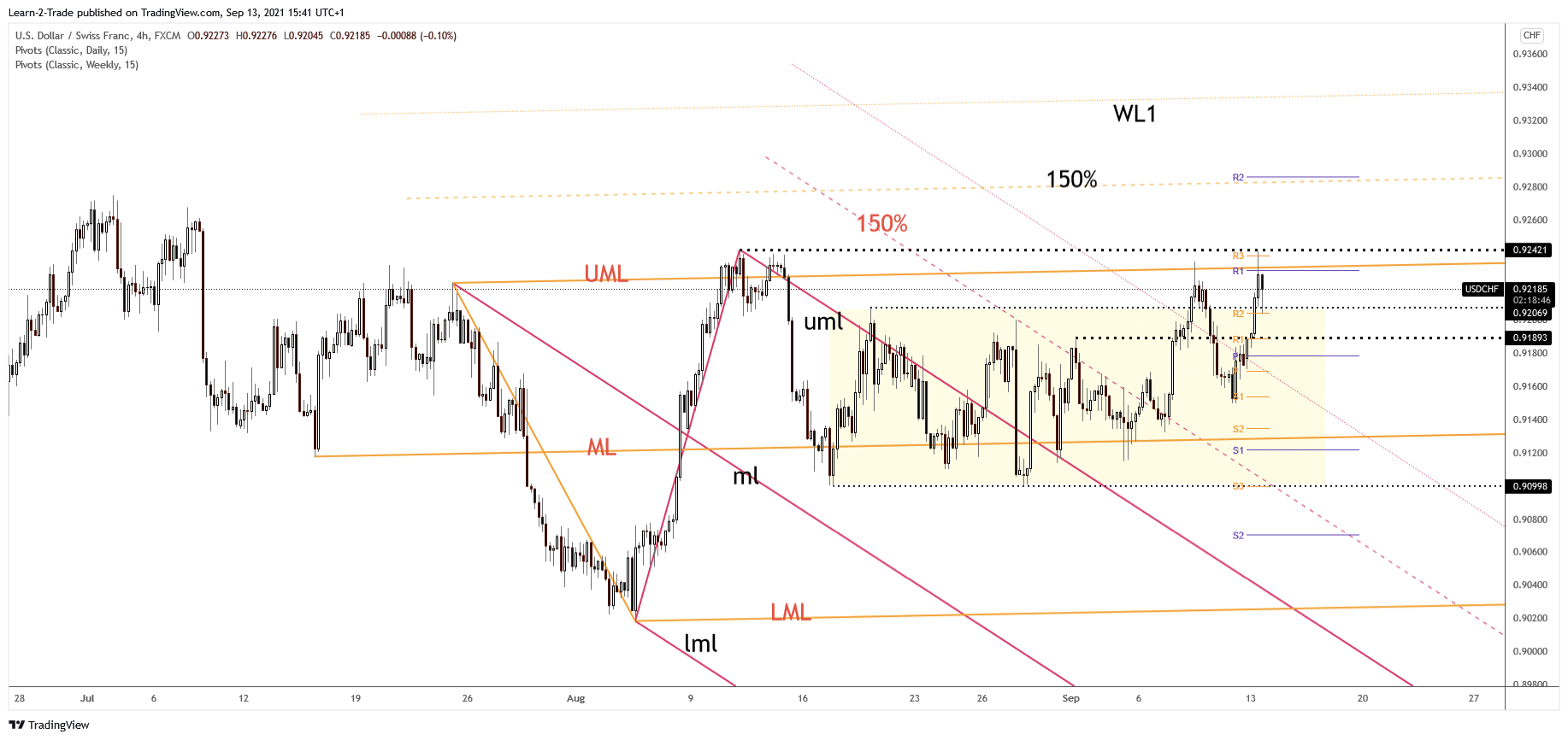

Our USD/CHF forecast finds the pair positioned within an extended sideways movement. It’s located at 0.9215 level which for forex traders still places it in a neutral zone.

Technically, making a new higher high could strongly activate an upside continuation. The pair has dropped in the last few hours as the Dollar Index (DXY) slipped lower after registering only false breakouts through an immediate upside obstacle.

3 Free Crypto Signals Every Week – Full Technical Analysis

The United States inflation data publication could change the sentiment tomorrow. The CPI is expected to increase by 0.4% in August versus a 0.5% growth in July, while the Core CPI may register a 0.3% growth in August, should be the same as in July.

Switzerland’s PPI will be published tomorrow and is expected to rise by 0.2% compared to 0.5% in the previous reporting period.

If you want to get involved with forex options trading, then check out our comprehensive guide on how to get started.

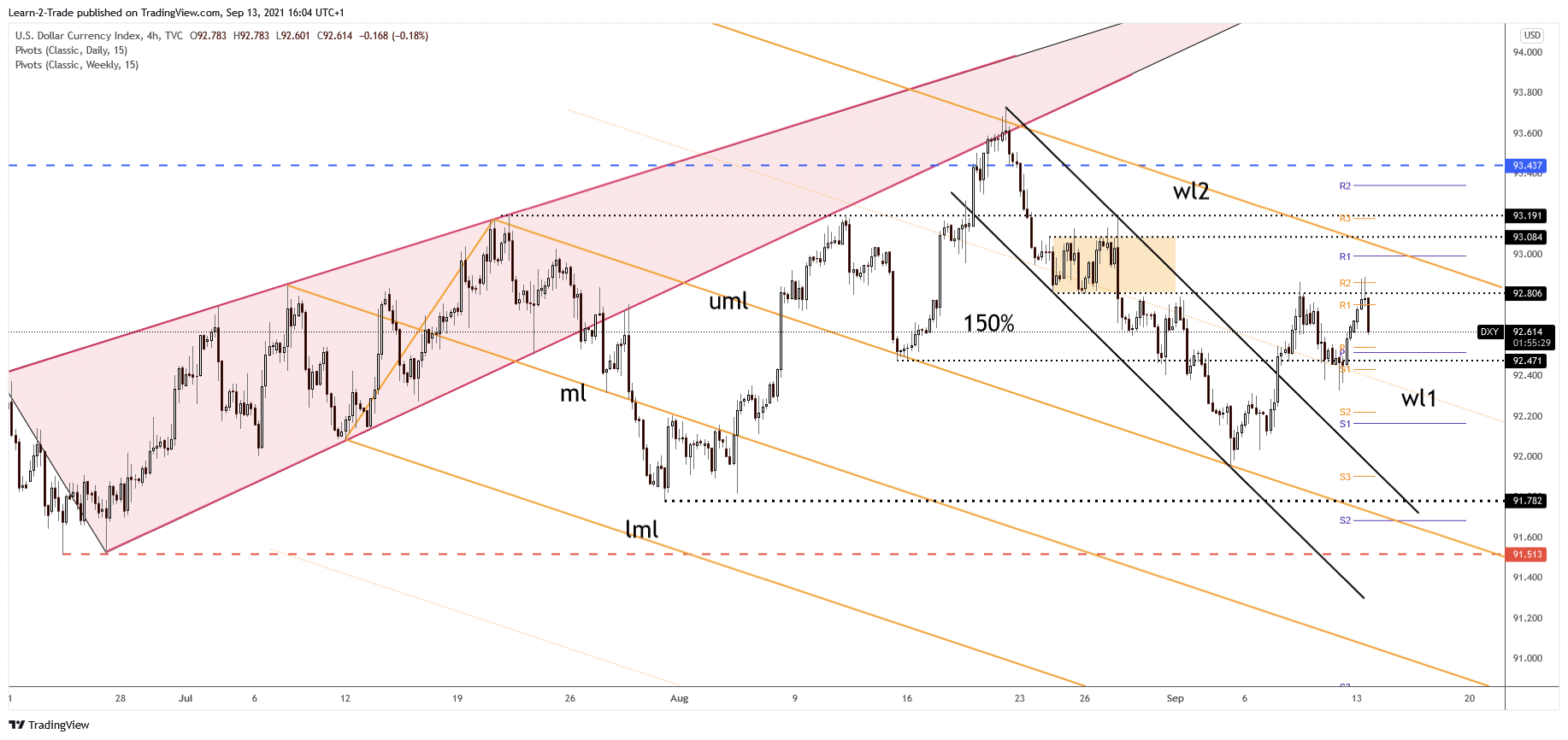

DXY Price Technical Analysis: False Breakout

The Dollar Index (DXY) was dropping like a rock at the time of writing after making two false breakouts with great separation above 92.80 static resistance. It could come back down to test the weekly pivot point (92.51) and the 92.47 static support.

After its recent rally, a temporary decline was probably expected. The second warning line (wl2) is seen as an important upside obstacle. Only a valid breakout through it may signal a broader upwards movement.

USD/CHF Forecast Technical Analysis: Upside Continuation

The USD/CHF pair dropped after making a false breakout through the weekly R1 (0.9229) and above the ascending pitchfork’s upper median line (UML). It has come back down to retest 0.9206 level (resistance has turned into support).

Technically, the pair is under bullish pressure after coming back above the range’s resistance of 0.9206. Still, only a valid breakout through the 0.9242, a new higher high could really activate a strong upwards movement.

The USD/CHF currently sits right below a resistance zone, so we’ll have to wait for a valid upside breakout through the immediate obstacles before considering going long.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.