The US dollar was seen trading lower Intraday against the Swiss franc, as there was selling interest noted. The US dollar also traded lower against currencies such as the Euro and the British pound. There is an important event lined up during the NY session in the US i.e. durable goods orders data will be published. The market is expecting it to register a gain of 0.5%, compared with the decline of around 18% last time. If the data misses the forecast and fails to register an increase, then the US dollar might move lower in the short term.

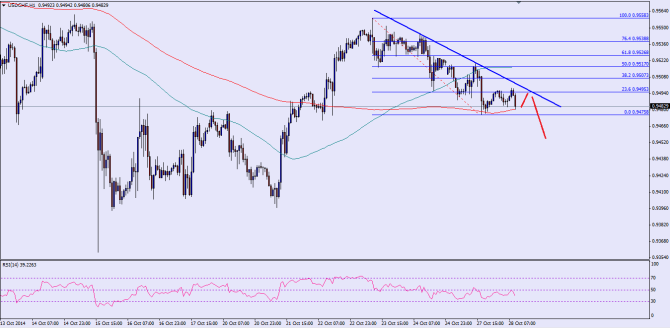

There is a monster bearish trend line formed on the hourly chart of the USDCHF pair, as can be seen in the chart below. The highlighted trend line might act as a catalyst for the pair towards the downside in the near term. The USDCHF pair recently failed around the 23.6% fib retracement level of the last drop from the 0.9558 high to 0.9475 low. Currently, the pair is testing the 200 hourly moving average, which is acting as a support for the pair and holding the downside. If the pair manages to clear the 200 MA, then it might head lower moving ahead. The next level of interest would be around the 0.9420 level.

The USDCHF pair is trading below the 100 MA, which can be seen as a bearish sign and might weigh on the US dollar in the short term. We need to see how it trades during the coming sessions.

Overall, one might consider selling with a break below the 100 MA.

————————————-

Posted By Simon Ji of IKOFX