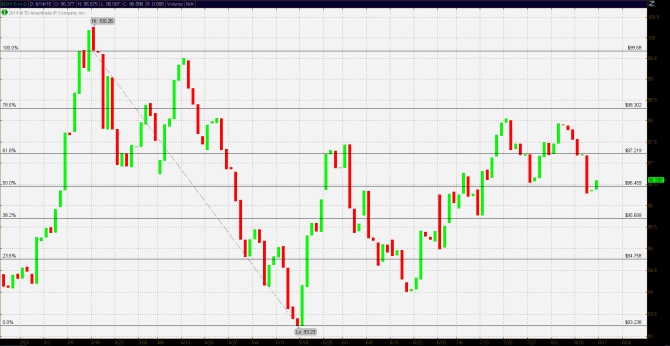

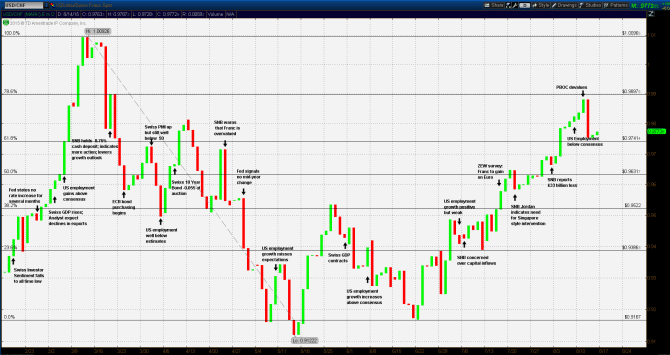

In mid-March the Swiss Franc weakened to virtual parity with the US Dollar at 1.00926. In the next eight weeks it steadily strengthened to its six month low to 0.91222 to the US Dollar, a 9.618% gain. In the weeks following USD/CHF six month high, the Franc steadily strengthened vs the greenback. In spite of the efforts of the Swiss National Bank to weaken the Franc in order to protect its export dependent economy, it stubbornly remained strong relative to the majors. With growing uncertainty over which way the US Federal reserve will direct its benchmark target overnight rate, the question becomes whether Fed actions will have a measurable impact on USD/CHF.

Weeks after the Swiss National Bank could no longer defend the Euro, there were still reverberations. For example, the Swiss ZEW investor survey plunged over 62 points, settling at a negative 73. The sentiment indicates, of the 350 economist surveyed over 250 expressed negative sentiment. Further, expectations and public SNB comments strongly indicated further action to weaken the Franc.

Guest post by Mike Scrive of Accendo Markets

In the US, the released FED minutes indicated the governing board of the US Fed was leaning towards maintaining rates in spite of relatively good employment reports, a key Fed metric: “…Many participants indicated that their assessment of the balance of risks associated with the timing of the beginning of policy normalization had inclined them toward keeping [rates at zero] for a longer time…“. Further, after other, slightly less than consensus data points, Chair Yellen explicitly stated that the Fed would be patient on rates.

At the following SNB meeting, Governor Jordan noted the excessively strong Franc, indicated the SNB readiness to intervene to protect export prices and lowered growth forecasts. Still, USD/CHF fell nearly 3% in one session, gaining back about half in the next. This may have been technical, since the Fed had just implied higher US deposit rates and the SNB had just implied even lower deposit rates. Another factor to be taken into account was the commencement of the ECB bond purchasing in March.

However, expectations of a June Fed increase diminished when the employment report indicated a sharp decline in job creation, by a substantial margin. Hence, with a contracting Swiss economy and a weakness in an important US data point, weakened the Franc vs the Dollar, to 0.9813 from 0.9504 over 10 trading sessions. Was the pair finally responding to economic data?

In April, the effects of negative interests and shrinking economy affected Swiss consumer prices creating deflation concerns. Yet, amazingly, the Swiss 10 year bond attracted enough demand at auction for bids on a negative 0.055% yield.

Inconsistent US economic data now made it unclear as to which way the Fed would lean by mid-year. Yet, in spite of dire SNB statements and extremely suppressed yields, investors still favored the Franc over the US Dollar. At the end of April, continued mixed economic data finally caused the Fed to signal a much later rate increase than had previously been anticipated. The Franc strengthened and USD/CHF trended lower towards its six month low at 0.91222 before reversing. The entire point being that the pair was not responding to data or to explicit public warnings that the Franc would be weakened still further.

By mid-May the SNB claimed that the negative rates were having a satisfactory effect on the Franc when compared to several major currencies. The Franc would test the six month low by the end of June and reaffirm support at 0.9168 then weaken from there after GDP showed continuing economic contraction.

However, the narrative then begs the question whether the SNB actions would be able to weaken the Franc at all and even then would demand for exports be robust enough to support growth? On the other hand, the Dollar strengthened on positive US economic data and increased expectations that the Fed was certain to raise in September. After testing six month support 0.9167, the USD/CHF began a steady trend up, most likely on the all but ‘assumed certain’ Fed September policy shift.

The urgency and frustration which the SNB faced with an intractable Franc was made clear in an interview with SNB Governor Jordan, when he expressed his desire for a Singaporean direct currency intervention model, which utilizes a basket of currency reserves to intervene ‘as needed’ in order to keep the currency in an unspecified range .

At the beginning of August, US employment was positive but again, below consensus. Further, the Fed did express concerns about global deflation, and concerns about capital outflows from emerging economies should they raise rates. Analyst expectations for the September rate increase, reported by the media as all but certain just days before, were suddenly at even odds. Further, on 10 and 11 August, the PBOC unexpectedly devalued the Yuan causing US bond yields to decline sharply. On the previous day, influential Fed board member, Mr. Stanly Fischer, indicated the September rate hike was not off the table but also not a certainty and ‘low inflation’ was an ongoing concern.

What does it add up to for USD/CHF? The PBOC move and declining global CPI will only increase the ‘flight to quality’. Chair Jordan seems to be fighting a rising tide, whereas Chair Yellen still has enough ‘slack’ to delay Fed action until at least December. If deflation has indeed become a global phenomenon, the SNB will have a tough time preventing a stubbornly strengthening Swiss Franc from strengthening further. Unless the SNB takes some extraordinary measures, it seems likely that USD/CHF, already near its 6 month highs, might correct from here.