Technical Bias: Bullish

Key Takeaways

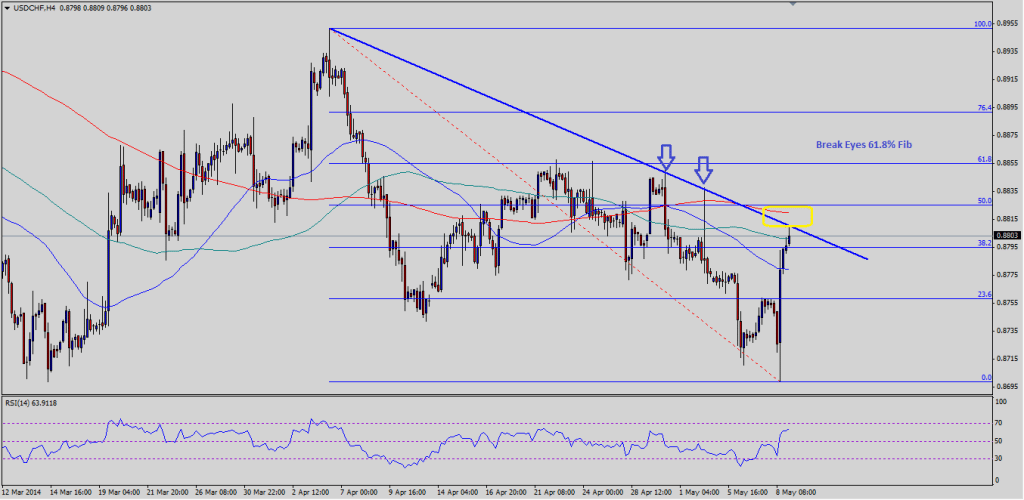

“¢ US dollar gains momentum against the Swiss franc, faces a huge resistance around 0.8810-20 area.

“¢ USDCHF bulls fail around a critical trend line.

“¢ Short-term support seen at 0.8780 and resistance around 0.8810-20 area.

The US dollar finally gained some bids against the Swiss franc to post an impressive 100-pip rally after the ECB’s press conference. However, the USDCHF pair faces a huge resistance, as it approaches a critical bearish trend line.

Bears To Take Charge?

The USDCHF pair pushed lower towards the previous monthly low again yesterday, at around 0.8700, but managed to survive a break and bounced back sharply to form a solid bullish candle on the daily timeframe. Now we are looking to see whether the USDCHF bulls can manage to take the pair higher and break a crucial bearish trend line connecting all previous swing highs. The mentioned trend line also coincides with a confluence area of two key simple moving averages – 200 and 100 on the 4 hour timeframe. There is a possible RSI divergence forming as well, which means the pair might consolidate in the coming session before deciding on the next move. If the sellers take charge and manage to push the pair lower from the current levels, then 50 SMA (4H) is seen an immediate short-term support. Any push lower might take the pair back towards the previous swing low of 0.8740.

Alternatively, if the sellers fail to defend the trend line resistance, then a break higher might take the pair towards the next area of interest – 61.8% Fibonacci retracement level of the recent leg lower from the 0.8952 top to 0.8699 low at 0.8855.

There is no major economic release scheduled in the US today. So, the market sentiment might come into play in the short term, as the chances of a break higher is limited due to the lack of economic data.