USDJPY broke an important triangle last Friday, and spiked higher. The pair traded sideways for some time before buyers jumped in order to push the pair above 102.40 and 102.60 resistance levels.

Earlier during the Asian session, Japanese industrial production data was published by the Ministry of Economy, Trade and Industry. The outcome was mixed, and as a result USDJPY mostly consolidated in a range.

Japan’s Industrial Production

Japan’s industrial production in February decreased 2.3% from the previous month, missing the expectations of a 0.3% gain, and IP increased by 6.9% from the previous year. Transport equipment, business oriented machinery, information and communication electronics equipment were the main industries contributing to the decrease. The report suggests that industrial production continues to show an upward movement. However, the recent slide for the first time in three months might put some pressure on the Japanese Yen in the short term.

Upcoming events: Yellen’s speech and Chicago PMI

Fed’s chairman, Yellen speech is scheduled later during the day, which might act as a catalyst for USDJPY pair. Chicago’s Purchasing Managers Index (PMI) will also be released, which is expected to register a decline of 1.3 points from 59.8 to 58.5.

Technical Analysis

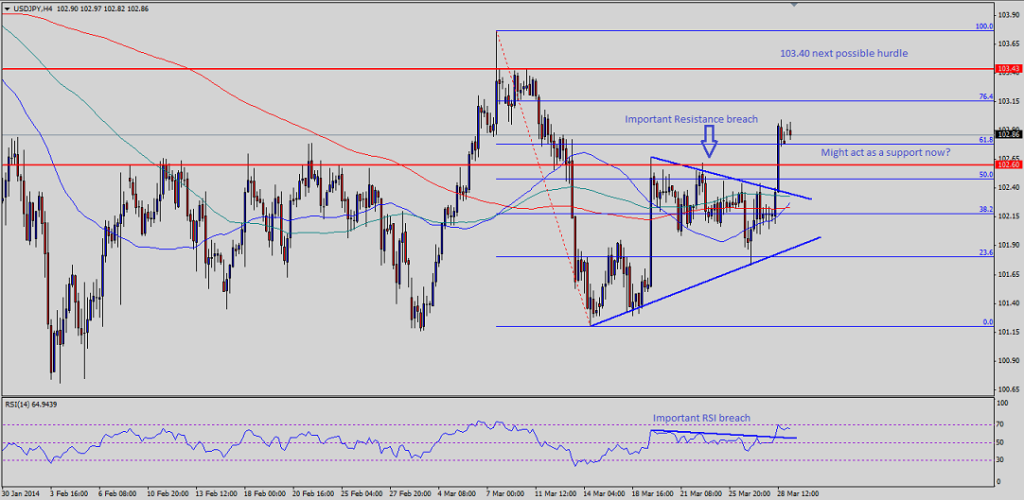

USDJPY successfully managed to break the triangle formed on the 4 hour time frame. The sellers failed to defend 50% and 61.8% Fibonacci retracement levels of the last leg lower from the 103.77 high to 101.20 low. 103.40 can be seen as the next major hurdle for the bulls, followed by 103.77, which also represents the March 2014 high.

The broken triangle resistance zone might act as a support for the pair. There was a trend line break noted in the RSI as well. After the break, RSI stopped right around extreme levels. The triple confluence support zone of 200, 100 and 50 moving averages could act as a pivot zone for the pair in the sessions to come.