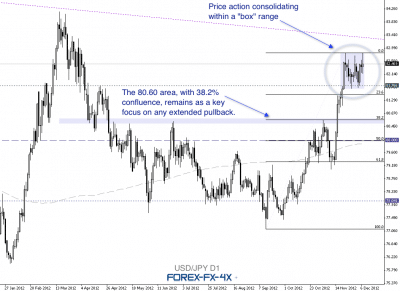

The dollar/yen pair is now caught within a “consolidation box” as a period of range trading is underway. A break above the recent range resistance level could see the USD/JPY threaten the 15/3/12 84.17 area highs and would mark a resumption of the mid-term strong upside trend.

Guest post by Nick Simpson of www.forex-fx-4x.com

Market participants will be monitoring the price action on any move back down to the box range lows. A sustained break under this area could see the 80.60 area prior resistance zone come back into focus as a potential support level. This area provided significant resistance on the move up.

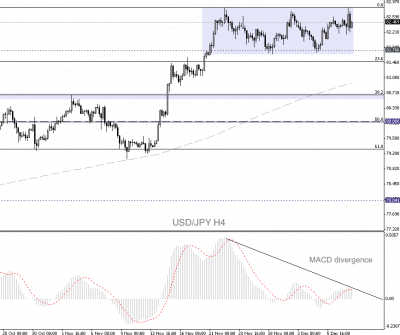

MACD divergence traders will have noted that the USD/JPY 4-hour chart is showing a MACD divergence scenario with price hitting the recent range highs and the MACD yet to rise in-line with price.

The daily timeframe Kijun Sen level is another technical area we will be monitoring and is currently located around 80.94 (this is one of the Ichimoku Kinko Hyo indicator components).