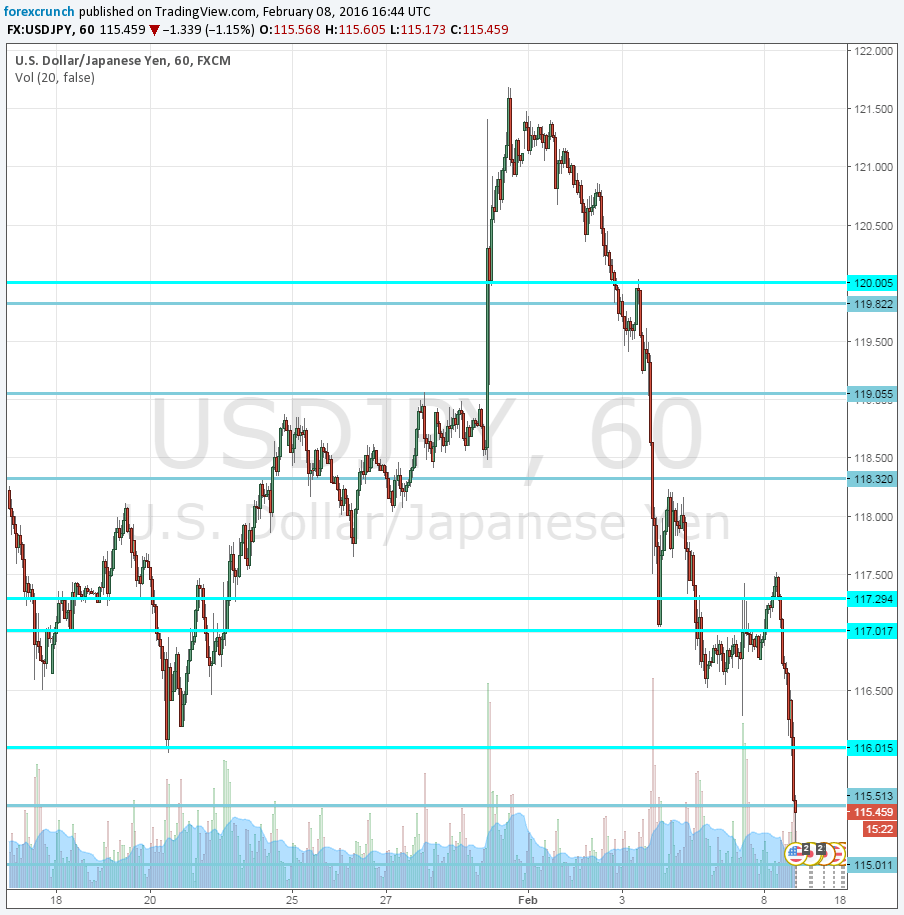

The Japanese is in high demand, with USD/JPY breaking below what previously seemed like “the line in the sand” for the BOJ: 116. The low so far is 115.17.

The team at Credit Agricole sees a buy opportunity:

Here is their view, courtesy of eFXnews:

In Japan BoJ Governor Kuroda stressed that the central bank needs to be accountable if it doesn’t meet the 2% inflation target and that inflation is steadily improving.

Given the most recent development there is no doubt that the central bank is indeed ready to turn more aggressive if needed. Strongly capped central bank rate expectations should keep the JPY capped.

However, in order to trigger a sustained downtrend from the current levels more sustainably improving risk sentiment is needed. For that to happen global growth expectations may have to improve.

Nevertheless, as of now we stay of the view that dips in pairs such as USD/JPY should be bought.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.