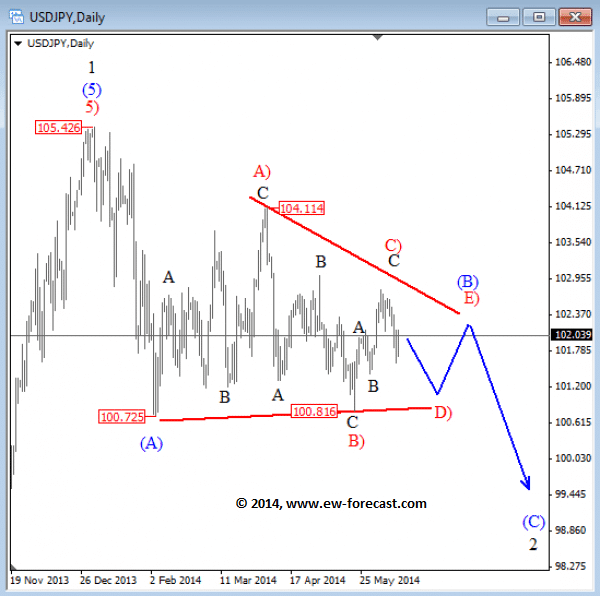

USDJPY has turned nicely down at the start of the year from 105.50. A decline can be counted in five waves in the shape of a leading diagonal, so we think that this is the first leg of a minimum three waves bearish structure.

Therefore we expect a decline through 100.72 and extensions beneath the 100 psychological level, but just not yet. Notice that in mid-May the market bounced from the 100.80 level after only three legs down from above 104.

A three wave structure is a correction so it seems that the decline was just part of a bigger and complex corrective wave (B) that can be a triangle if we consider latest three wave rise up in wave C that appears complete, so the current leg down is wave D).

USDJPY Daily Elliott Wave Analysis

Elliott Wave Education: Triangle Pattern

A Triangle is a common 5 wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature. Triangles move within two channel lines drawn from waves A to C, and from waves B to D. A A triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3.