The team at Goldman Sachs notes an exhaustive shooting star pattern in USD/JPY. Is it ready for a big fall?

In EUR/USD, the picture is more complex, and the institution notes two upside targets:

Here is their view, courtesy of eFXnews:

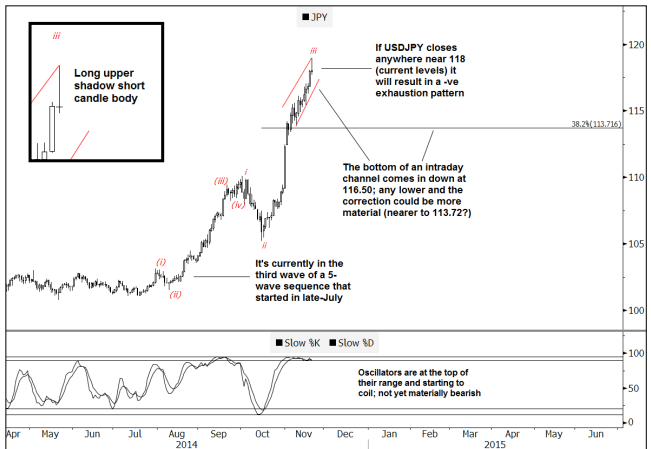

At current levels, USD/JPY appears to be forming what looks like an exhaustive shooting star, notes Goldman Sachs.

These types of patterns, according to GS, often precede corrective pullbacks.

“In terms of levels, the first notable support comes in at the base of a minor channel formed off the earlyNovember low; 116.50. Any move further than that point could warn of a more material correction, something closer to 113.72 (38.2% of the Oct. 15th/Nov. 20th rise),” GS projects.

In line with this view, GS argues that 119 seems a decent level to take a more neutral near-term approach until further signal develops.

Meanwhile in EUR/USD, GS notes that the longer it remains above 1.2395 the more likely it is to have started a corrective phase.

“Two feasible upside targets for a correction are i) 1.2886; the top of wave 4 and ii) 1.2983; 38.2% of the drop from May. The downside risks below 1.2395 are centered on 1.2090-1.2043; a 1.618 extension target for wave 5 and the target provided by the ’12 wedge,” GS projects.

“Bottom line, a correction is counter-trend and by nature not impulsive,” GS concoludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.