The Japanese yen showed significant volatility last week, and USD/JPY gained 150 points on the week, closing just shy of the 114 line. This week’s key event is Retail Sales. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

US durable goods sparkled last week, while consumer confidence reports were mixed. Japanese inflation indicators missed expectations, underscoring weakness in the Japanese economy.

do action=”autoupdate” tag=”USDJPYUpdate”/]

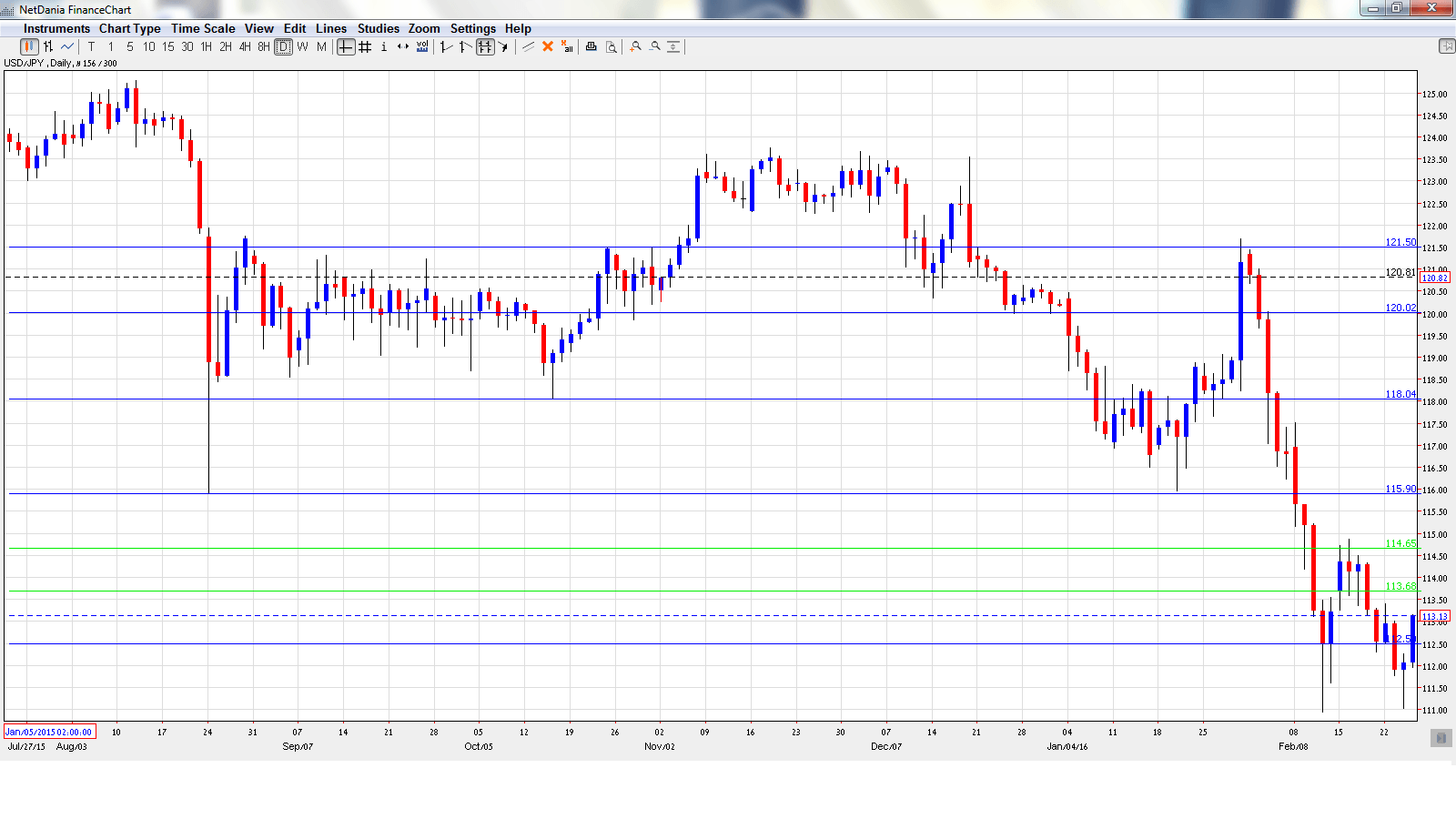

USD/JPY graph with support and resistance lines on it:

- Retail Sales: Sunday, 23:50. The week kicks off with Retail Sales, the primary gauge of consumer spending. The indicator has been struggling, posting three declines in the past four releases. The markets are expecting better news in January, with an estimate of 0.2%.

- Housing Starts: Monday, 5:00. This indicator provides a snapshot of the level of activity in the housing sector. The indicator reversed directions in January, declining by 1.3%, compared to the forecast of 0.5%. Another decline of 0.2% is expected in the February report.

- Household Spending: Monday, 23:30. Japanese consumers are cutting down on spending, as this indicator posted only two gains in all of 2015. In January, the indicator plunged 4.4%, well off the forecast of -2.3%. The markets are braced for another decline in February, with an estimate of -2.5%.

- Capital Spending: Monday, 23:50. This indicator measures spending in the business sector. In January, the indicator surged 11.2% in Q3, crushing the estimate of 2.3%. Another sharp gain is expected in the Q4 report, with the estimate standing at 8.8%.

- Final Manufacturing PMI: Tuesday, 2:00. This PMI has posted readings slightly above the 50-level since May 2015, indicative of limited expansion in the manufacturing sector. The estimate for February is 50.2 points.

- 10-year Bond Auction: Tuesday, 3:45. Yields on 10-year bonds have been dropping since mid-2015, and the February figure fell to just 0.08%. Will the downward trend continue in March?

- Monetary Base: Tuesday, 23:50. Monetary Base has been falling steadily, and posted a reading of 28.9% in January, within expectations. The downswing is expected to continue in the February release, with an estimate of 27.9%.

- Average Cash Earnings: Friday, 1.30. This indicator is linked to consumer spending, a key driver of economic growth. The indicator posted a weak gain of 0.1% in December, well short of the forecast of 0.7%. Little change is expected in the January report, with an estimate of 0.2%.

* All times are GMT

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

USD/JPY Technical Analysis

USD/JPY opened the week at 112.52 and dropped to a low of 111.03. The pair then reversed directions and climbed to a high of 113.96, as resistance held firm at 114.65 (discussed last week). USD/JPY closed the week at 113.96.

Technical lines from top to bottom:

118.05 was a cushion in October 2015.

116.90 supported dollar/yen early in 2015.

115.90 was an important cushion in the second half of 2015.

114.65 is next.

113.71 was an important resistance line in July 2005.

112.48 marked the start of a yen rally in January 2008, which saw USD/JPY drop below the 100 level.

110.68 represented a high point of a strong dollar rally in August 2008, which started around the key 100 level.

I am bullish on USD/JPY

US fundamentals are showing some improvement after a lukewarm start to 2016. Japanese numbers have been sluggish, and weak inflation numbers have raised the prospect of further easing by the BoJ, which would likely push the yen to lower levels.

Our latest podcast is titled Time for Regrets? Referendum and Rates version

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.