- The USD/JPY is strongly bullish as it could approach and hit fresh new highs.

- A temporary retreat could help us to catch new long opportunities.

- The USD could drag the pair higher if the Dollar Index makes a valid breakout through the 93.43 resistance.

Our USD/JPY forecast notes that the pair has increased as much as 110.56 today, where it has found resistance again. Now it’s trading at 110.54 level. Technically, the bias remains bullish despite temporary retreats. The pair could only test the immediate support levels before jumping higher again.

From the technical point of view, the USD/JPY pair has taken out, ignored, strong upside obstacles signalling an upside reversal. I believe that a temporary decline could help us to catch a new swing higher.

3 Free Forex Every Week – Full Technical Analysis

In the early morning, Japan released the Flash Manufacturing PMI which dropped from 52.7 to 51.2 points below 52.5 expected announcing a slowdown in expansion. In addition, the National Core CPI rose by 0.0% as expected.

Later today, FED Chair Powell Speaks may bring high volatility and high action. Also, the New Home Sales is expected to rise from 708K to 712K. This could be good for the US Dollar. You should know that the USD/JPY rallied in the short term only because the Japanese Yen was punished by the dovish BOJ. Also, the Nikkie stayed higher signalling weak JPY.

The USD could take full control and lead the pair higher towards fresh new highs only if the Dollar Index jumps towards fresh new highs.

USD/JPY Forecast: Technical Analysis

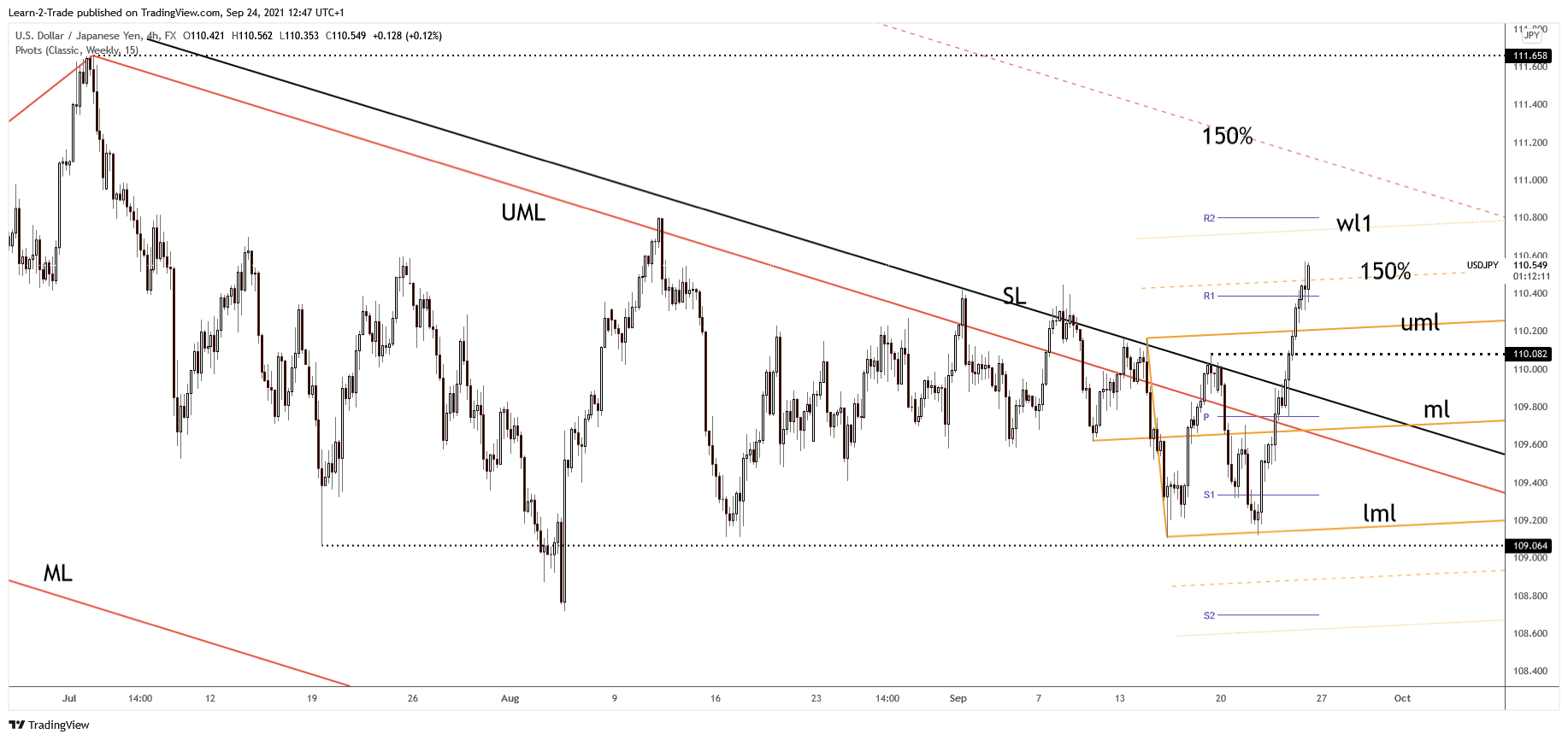

The USD/JPY pair stayed near the upper median line (UML) and right under the sliding line (SL) indicating an imminent upside breakout. After retesting the weekly pivot point (109.75), the pair registered a sharp rally.

The aggressive breakout through the sliding line (SL) and above the 110.08 former high announced strong buyers.

It has also ignored the ascending pitchfork’s upper median line (uml) and now it stands above the weekly R1 (110.38) and beyond the 150% Fibonacci line of the ascending pitchfork. Stabilizing above these levels may signal further growth at least until the warning line wl1.

The weekly R2 (110.80) and the 150% Fibonacci line of the descending pitchfork are seen as upside targets as well. A temporary decline towards the ascending pitchfork’s upper median line (uml) could bring new long opportunities.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.