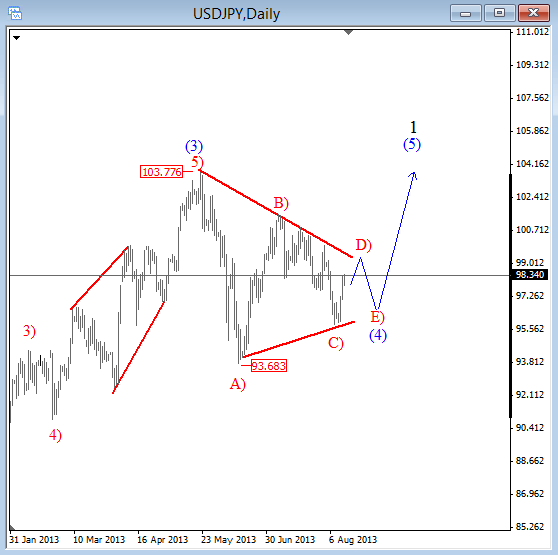

USDJPY found support this week around 95-96 level as expected from where a sharp rally suggests that the market accomplished wave C) of a triangle and that the price is now moving higher in wave D), still only a fourth leg within a complex correction.

But we need 5 of them, so beware of more choppy and overlapping price action in the 95.80-101.50 range during the days ahead before the market breaks to the upside.

What is a triangle in Elliott Wave Theory?

A Triangle is a common 5 wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature. Triangles move within two channel lines drawn from waves A to C, and from waves B to D.

A Triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3.

“¢ The structure is 3-3-3-3-3

“¢ Each subwave of a triangle is ussaly a zig-zag

“¢ Wave E must end in the price territory of wave A

“¢ One subwave of a triangle usually has a much more complex structure than others subwaves

“¢ Appears in wave four in an impulse, wave B in an A-B-C, wave X or wave Y in a double threes, wave X or wave Z in a triple