Dollar/yen dipped lower but sprung up and ended the week higher as the Fed raised rates and the BOJ is not going anywhere fast. Here is an outlook for the key levels to watch on the pair with a note of key movers.

This is a new format of the outlook and feedback is welcome. We cover the top fundamental news and outlook, a technical analysis on the daily chart and finally sentiment for the pair moving forward.

USD/JPY fundamental movers

Weak US inflation sent the pair lower until the Fed explained it was only due to one-off factors. The FOMC raised rates and left the path for rate hikes unchanged. And not only did they dismiss inflation, but they also expressed confidence on growth and employment. All this

All this led to a stronger dollar. The greenback ignored new political revelations. Trump is under investigation for obstruction of justice and his son in law Jared Kushner is also eyed for his ties.

The upcoming week features various Fed speakers, with Dudley on Monday and Fischer on Tuesday standing out. Also, note existing home sales on Wednesday and new home sales on Friday.

See all the main events in the Forex Weekly Outlook

In general, $/yen hardly moves on Japanese events, but the BOJ did manage to move markets by not moving. Kuroda said that discussing any kind of an exit strategy is premature.

The upcoming week features Japanese trade balance, old monetary policy minutes and the flash manufacturing PMI. None of these events are expected to be market movers. However, any geopolitical developments from North Korea or the Middle East could have an impact.

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

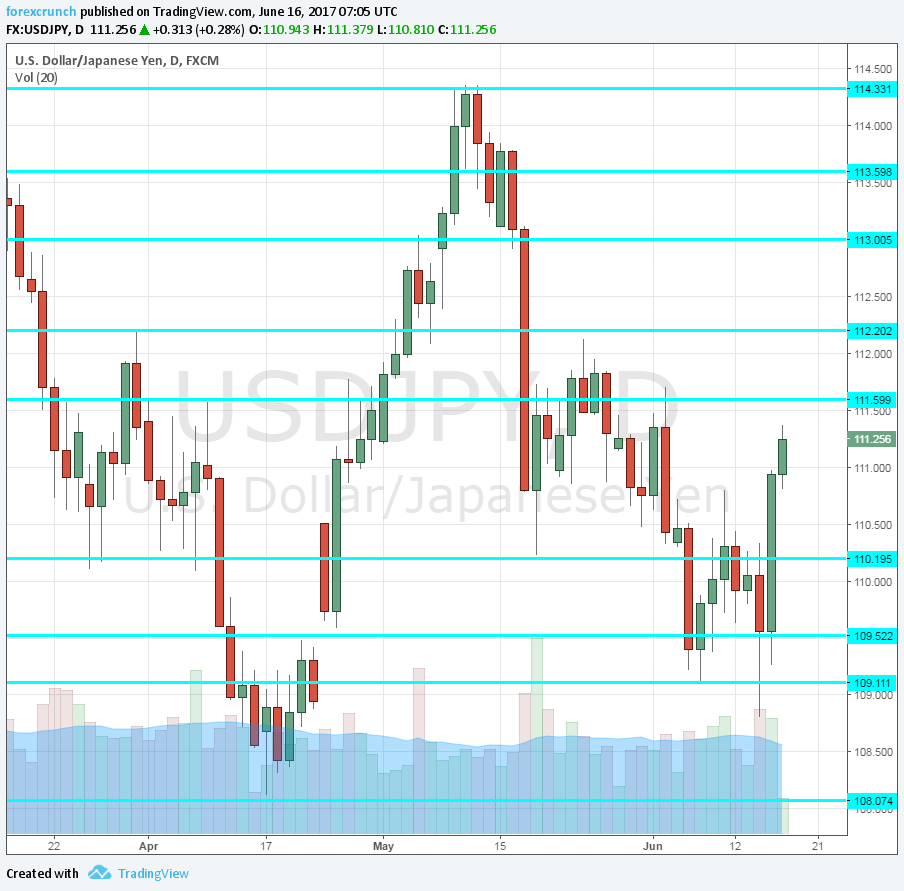

The current range for the pair is the wide area between 110.20 and 111.60. 110.20 was a swing low in May and 111.60 was a triple-bottom early in the year.

Looking up, 112.20 is resistance after capping the pair in April and in May. It is followed by the round level of 113, which was a stepping stone on the way up. Further resistance is at 113.60 which served as resistance in the past.

The cycle high of 114.30 is a strong level of resistance, the highest since March. Further above, 115 and 115.35 are notable.

Looking down, 109.50 was a gap line in late April, a gap that was never closed. In June, the pair found support several times at 109.10 and this also works as support.

Further below, the cycle low of 108.10 is of high importance. Looking lower, we are back to levels seen in November, but the door is basically open to 105.

USD/JPY Daily Chart

USD/JPY Sentiment

The pair jumped on a hawkish Fed and a dovish BOJ. Can this continue? For now, it is hard to see the pair digging lower, but gains are also limited. US figures can continue disappointing and send the pair lower, but this is not likely soon.

All in all, the tables have turned and the pair is no longer trending down.

Our latest podcast is titled Fed faking it until they make it? + a Brexit brawl