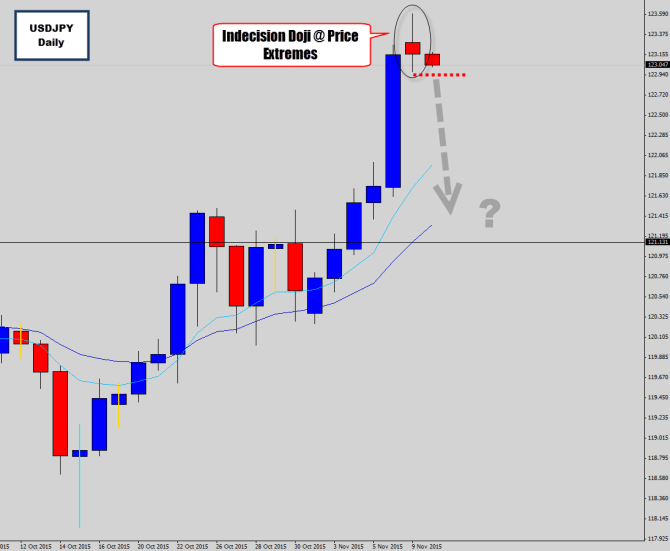

USDJPY launched upwards last week, especially after the NFP data was released towards the end of week. This caused some nice moves in many markets, including this one – which was influenced heavy by the USD strength.

In the War Room we do a lot of mean value analysis, which is the study of price in reference to the mean. One of the things this type of analysis can provide is visual over extension cues for the market. We can see here price has accelerated away from its mean value, creating that classic over extension gap.

We also have an indecision Doji candle, that has a bearish close in it’s body – communicating a potential reversal.

If price does break the Doji structure lows, it could kick off the mean reversion move. Generally when these setups play out as expected – the moves are quite violent.