While movements on both major pairs are not that huge, the interesting technical patterns promise further action later ahead.

Here is the view from Nomura:

Here is their view, courtesy of eFXnews:

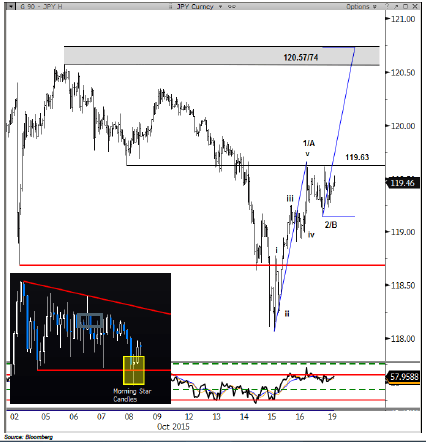

The bullish hammer candle that created a bear trap in USD/JPY has morphed into a similarly bullish morning star pattern now and promotes additional upside, notes Nomura.

“A break of 119.63 this week will clear a path to pivot and extension targets at 120.57/74. Further adding to the bullish n/t case is the 5-wave rally of the low,” Nomura projects.

“Since this was an impulse, we need at least one more impulsive rally to mark wave-C or 3.

Pullback support is 119.14 while a breakout above 119.63 will shift focus to the next pivot at 120.35,” Nomura adds.

Turning to EUR/USD, Nomura notes that Friday’s sell-off confirmed the bearish engulfing candles and this bearish pattern occurred at a key 61.8% retracement which adds to its significance as a reversal pattern.

“Now the market is declining in impulsive fashion and we expect additional downside,” Nomura argues.

“S/t, a 5-wave decline and 3-wave correction not only marked waves-1 & 2 of a new decline but also completed a head & shoulders top pattern.

The projection targets from wave-3 and the topping pattern are 1.1230 & 1.1174,” Nomura projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.