Dollar/yen tested lower ground and marked a new bottom. Will the BOJ intervene? Monetary Policy Meeting Minutes and Average Cash Earnings are the major events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week trade balance deficit narrowed nicely to 0.02T following 0.27T shortage but retail sales dropped more than expected by 1.2% and household spending improved with 1.9% drop after decreasing 4.1% in August. These mixed readings reflect the concerns Japan over the global financial markets situation. Will we see an improvement following the positive EU summit in Brussels?

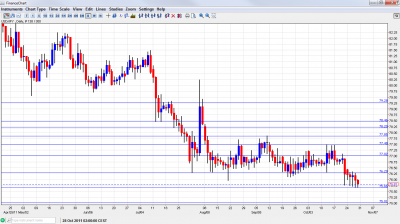

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Sunday, 23:15. Japanese manufacturing activity dropped below the 50 point line in September to 49.3 from51.9 in the previous month. This is the first drop in five months amid a decrease in exports caused by the strong yen and lower global demand.

- Housing Starts: Monday, 5:00. Housing starts in Japan jumped unexpectedly by 14% in August from a year earlier amid growing demand for construction after March earthquake and tsunami. A smaller climb of 8.9% is predicted.

- Monetary Policy Meeting Minutes: Monday, 23:50. The last BOJ meeting dealt with the EU debt crisis and its possible effect on the Japanese economy it was decided to continue the monetary easing program to boost the economy.US economic slowdown was also discussed. The BOJ decided to offer low-interest loans for the purchase of property and extend a special fund totaling 10 trillion yen.

- Average Cash Earnings: Tuesday, 1:30. Japanese total wage income fell 0.6% in August from a year earlier. This is the third consecutive decrease following 0.1% drop in the previous month. A smaller drop of 0.3% is expected now.

- Monetary Base: Tuesday, 23:50. Japan’s total domestic currency in circulation increased by 16.7% in September from a year earlier following 15.9% gain in the previous month indicating improved market conditions. Economists predicted 16.3% increase. A further increase of 17.3% is forecasted.

- G20 Meetings: Thu-Fri. This is the sixth meeting of the G-20 policy makers gathering in Paris. This meeting will be dedicated almost exclusively to the euro zone debt crisis fearing default in Greece and the heightened risks toSpain’s growth outlook in light of its high unemployment rate and tighter financial conditions. They will also discuss plans to enhance EFSF resources in case it will need to bailout larger economies like Italy or Spain.

*All times are GMT

USD/JPY Technical Analysis

Dollar/yen was capped under the 76.25 line (mentioned last week) throughout most of the time. It dipped to new lows, reaching 75.66.

Technical lines from top to bottom

79.30 proved to be a stubborn cap for dollar/yen, holding down recovery attempts. It was last seen in July. 78.50 provided some support before another drop, and is now a weak line of resistance.

77.85 was tough resistance when the pair made an attempt to make an upwards move higher in September. 77.50 has a stronger role recently, after capping fresh attempts to move higher once again during October.

The round number of 77, remains a significant cap for the range trading that characterizes the pair even although it’s weaker now. Further below we have the swing record low of 76.25 which is still of importance after working well as resistance.

The new record low of 75.66 worked well as such after the initial touch and it provides support. Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I am neutral on USD/JPY.

In the long run, the pair has chances of rising, given the recent good signs from the US. In addition, the BOJ might intervene. But currently, the moves remain limited.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.