Dollar/yen remained in range and couldn’t move up, despite good US data. The rate decision is the main event this week. Here is an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week Japan’s large manufacturer’s sentiment dived to-4 in the third quarter from2 inthe second quarter amid worsening conditions in foreign markets and the yen appreciation and the floods in Thailand resulting in lower exports. The reading was below the -2 drop predicted. However the service sector dealing with domestic consumers unaffected by foreign markets, were quite optimistic with a reading of 4 after reaching1 in the second quarter. The figure was well above the1 pt. predicted. However unless foreign market conditions improve, Japanese economy could face a recession.

Updates: The death of North Korean ruler Kim Jung Il sparked some fear and weakened the yen, but this was short lived and the pair is around 78 as usual. The pair remains stable in face of mess in Europe. See how to trade the US jobless claims with USD/JPY. Dollar/yen is stable above 78, after the BOJ presented no surprises. US jobless claims could impact the pair. Dollar/yen is in range. US jobless claims remained low, but GDP was revised to the downside.

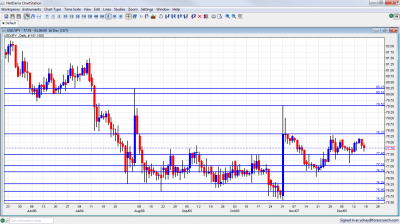

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Trade Balance: Tuesday, 23:50. Exports dropped more than predicted in September due to a sharp decline in demand in light of the European debt crisis and the appreciation of the yen. The decline in exports resulted in a JPY 458 billion deficit after JPY 97 billion in September. The flooding in Thailand also damaged production in the Japanese car industry and shipments to China have been reduced considerably. Deficit is expected to narrow to -0.28T.

- Rate Decision: Wednesday. The Bank of Japan held its interest rate at 0-0.10% without changes in its 55 trillion yen quantitative easing program. The BOJ warned about the slowdown in overseas economies hurting Japan’s recovery despite the rising domestic demand growth is expected to be moderate due to external pressures. No change forecast.

- BOJ Monthly Report: Thursday, 5:00. In its previous report, the Bank of Japan was more hesitant regarding Japan’s financial outlook in the face of slowing global demand and the strong yen. As a result, the BOJ lowered its economic assessment in October.

* All times are GMT

USD/JPY Technical Analysis

Dollar/en traded in the same 77.50 to 78.30 range (mentioned last week) and closed the week less than 20 pips higher.

Technical lines from top to bottom

80.25 was a swing low in June and a peak in July. The round figure of 80, which provided strong support, is the next line, and it is of high importance.

79.50, is the next line of resistance. This is the line that was reached after the recent intervention. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support.

77.50 is now weaker once again, although it is still of importance after capping fresh attempts to move higher once again during October. It turned into support after the intervention and assumes this role once again. The round number of 77, remains a significant cap for the range trading that characterizes the pair and proved to be stronger now.

76.75 follows closely after providing strong support of late. Further below we have the swing record low of 76.25 which is still of importance after working well as resistance.

A previous low of 75.95 is minor support. The last record low of 75.57 where the BOJ intervened is the final frontier in charted territory for now.

Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I am neutral on USD/JPY.

Positive signs from the US, such as jobless claims and the Philly Fed index provide a basis for a long term run in the pair, especially on the background of the troubles in the Japanese economy – troubles seen in the Tankan index. Nevertheless, the pair will likely continue moving very very slowly.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.