Dollar/yen kept on eroding the gains made after the intervention. Will the stealth moves of the BOJ push the pair back up? GDP figures and interest rate decision are the major events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week Leading indicators dropped to 91.6 from 93.8 in July, while Current account increased export surplus, reaching 1.19T from 0.75T in July, and Business confidence improved for the first time in three months, reaching 45.9 from September’s 45.3 indicating recovery, but still below the 50 point line. Will this recovery continue?

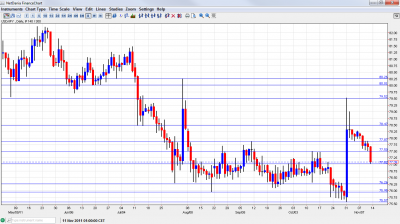

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Prelim GDP: Sunday, 23:50. Japan’s economy contracted in the second quarter by -0.3% according to the preliminary GDP figures which were revised down to -0.5% due to global financial concerns and the strong yen. However Japanese economy is expected to grow in the third quarter amid the recovery of supply chains destroyed in the March 11 earthquake. Hopes are high this time: a strong rise of 1.5% is expected.

- Prelim GDP Price Index: Sunday, 23:50. Prelim GDP Price Index plunged 2.2% on a yearly bases in the second quarter indicating significant contraction in inflationary growth. Analysts expected 1.7% contraction while the previous reading stood at -1.9%. A drop of 2.2% is likely now.

- Revised Industrial Production: Monday, 4:30.Japan’s industrial production increased 0.6% in August below the 0.8% rise anticipated acknowledging the recovery is underway. However the outlook is not clear due to a troubled global economy and the strong yen. The figure is expected to be revised to the upside: a drop of only 3.7%.

- Interest rate decision: Wednesday, The Bank of Japan kept interest rates unchanged at 0-0.1%. Eight members voted to further increase asset purchases by 5 trillion yen to 20 trillion yen, in order to ease monetary policy and weaken the yen. Perhaps more QE will be presented as will more determination to weaken the yen. The success has been limited so far.

- BOJ Monthly Report: Thursday, 5:00. BOJ monthly report released in October indicates that Japan’s economic activity continued to rise with production returned to normal levels of production following after the earthquake and tsunami. Restoration work contributed Japan’s growth rate. Private consumption increased modestly, and housing investment showed signs of recovery.

*All times are GMT

USD/JPY Technical Analysis

Dollar/yen dropped throughout the week. After losing the 77.85 line, the pair traded in a perfect range between 77.50 to 77.85 (both mentioned last week). It then made another move lower, eventually bouncing off the 77 line.

Technical lines from top to bottom

80.25 is a minor resistance line after working as support at the same period of time. It is closely followed by the round number of 80, which provided strong support.

79.50, is the next line of resistance. This is the line that was reached after the recent intervention. 78.50 capped a second recovery attempt in November, after the intervention and had an important role earlier as well.

77.85 was tough resistance when the pair made an attempt to make an upwards move higher in September, and cushioned the drop of USD/JPY after the intervention. It is a distinct line separating ranges. 77.50 has a stronger role recently, after capping fresh attempts to move higher once again during October. It turned into support after the intervention and is now resistance once again. It is also very distinct.

The round number of 77, remains a significant cap for the range trading that characterizes the pair and proved to be stronger now. Further below we have the swing record low of 76.25 which is still of importance after working well as resistance.

A previous low of 75.95 is minor support. The fresh record low of 75.57 where the BOJ intervened is the final frontier in charted territory for now. Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I turn from bearish to neutral on USD/JPY.

Indeed, the effect of the intervention faded out in a quick manner and the pair is lower once again. From here, bad European news can push it even lower, but these moves can be balanced with some stealth intervention by the BOJ.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.