Dollar/yen remained pressured to the downside on a flare-up around North Korea. Yellen’s lack of hawkishness in Jackson Hole continued reverberating and weighed on the US dollar. What’s next? North Korea’s massive nuclear test over the weekend could weigh quite heavily on the pair.

USD/JPY fundamental movers

North Korea, Yellen

After a few quiet weeks in northeast Asia, the rogue regime in North Korea fired a missile above Japan’s Hokkaido island, scaring the world. The Japanese yen, a safe-haven asset, gained ground.

In addition, the US dollar continued slipping as the Federal Reserve seems in no hurry to raise interest rates.

Services sector report, Japan’s GDP

The week starts a bit slowly with the Labour Day weekend in the US. Nevertheless, markets in other places are open and will probably provide another reaction to the Non-Farm Payrolls report. Later, the ISM Non-Manufacturing PMI will stand out, as well as the factory orders numbers.

In Japan, we will get an update on GDP after the preliminary report showed a robust growth rate of 1% q/q.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

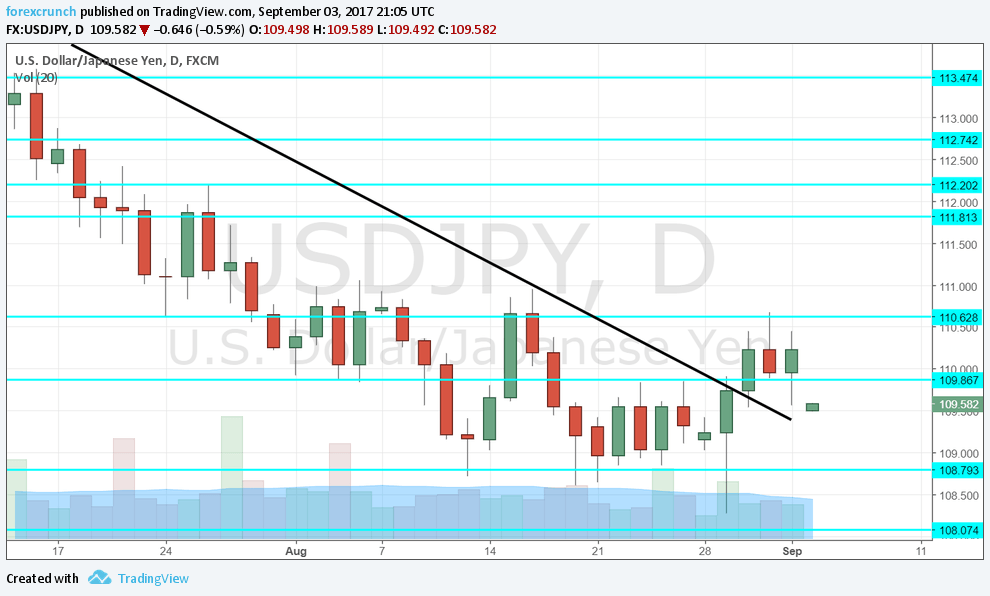

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance. Looking lower, we are back to levels seen in November, but the door is basically open to 105.

Downtrend resistance

As the black line on the chart shows, the pair is capped by downtrend resistance formed at the peak of 114.50 and followed

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

Renewed geopolitical tensions around North Korea joins the issues of the US economy. The troubles of President Trump do not help either.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!