Dollar/yen extended its downward slide as the US dollar was hit, this time mostly by politics. The BOJ was in the background. Will this continue? The technical pattern called “death cross” implies that it will.

Is this the beginning of a downturn or a necessary correction on the way up?

USD/JPY fundamental movers

Trumpcare fail and the BOJ

The ground was fertile: weak inflation data, Yellen’s caution and the travails of Don Junior. It was all joined by a failure of Senate Republicans to pass a new health care bill. In itself, it wasn’t a huge surprise, but it sparked another sell-off.

A second blow came closer to Trump: the special counsel Mueller is set to probe Trump’s business dealings. That revelation sent the dollar plunging across the board. The chances of enacting any type of tax reform or infrastructure spending seem remote.

USD/JPY was already ready for this, after losing downtrend support. The pair retreated deeper underground.

Fed decision, GDP and more

Trading this week is focused on the US with the Fed decision. Despite the absence of new forecast, nor a press conference, the event will surely gain attention. The big question is: does the Fed still see inflation as transitory? If so, the dollar has room to recover. If it changed its collective mind, further falls could be seen.

The GDP report is also of high importance as it is the first estimate for Q2 after a poor Q1 and a mediocre 2016. A pickup is growth is expected, but how strong will it be?

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

115.35 is the next line of resistance in case the pair break the cycle high of 114.30 which remains critical resistance after capping the pair back in May. The break to 114.50 did not go very far.

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance. Looking lower, we are back to levels seen in November, but the door is basically open to 105.

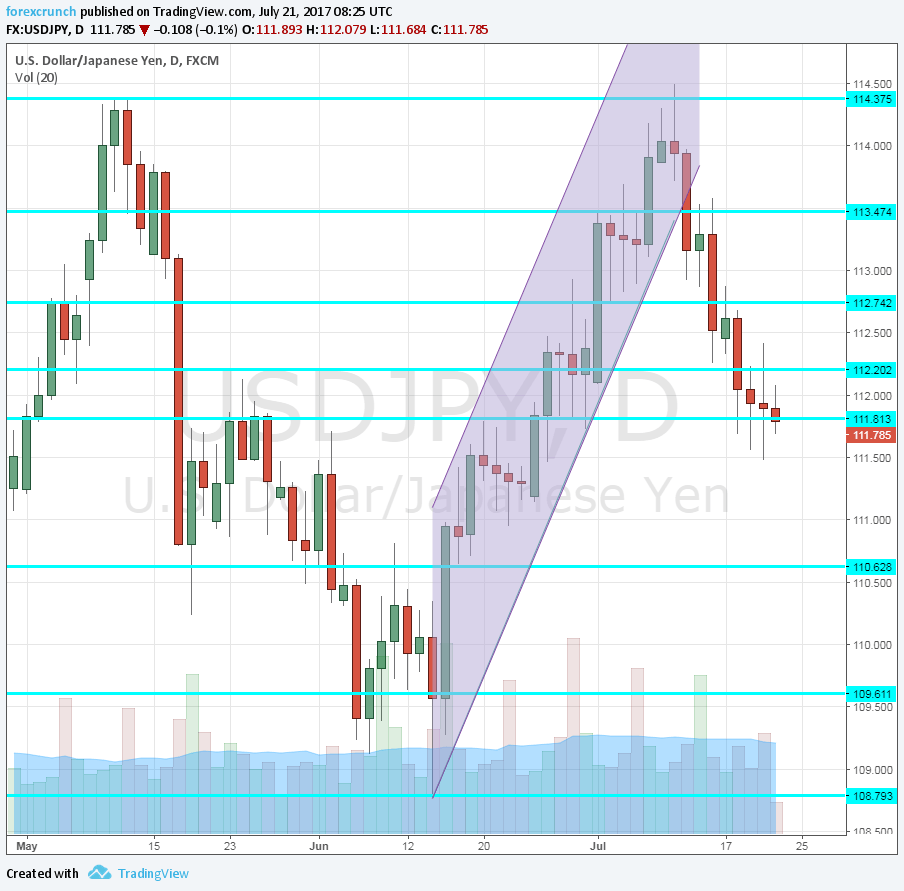

Steep uptrend support clearly broken

After slipping off the steep line of uptrend support, the pair not only went further away from the uptrend but continue lower. The break is more than confirmed.

USD/JPY Daily Chart

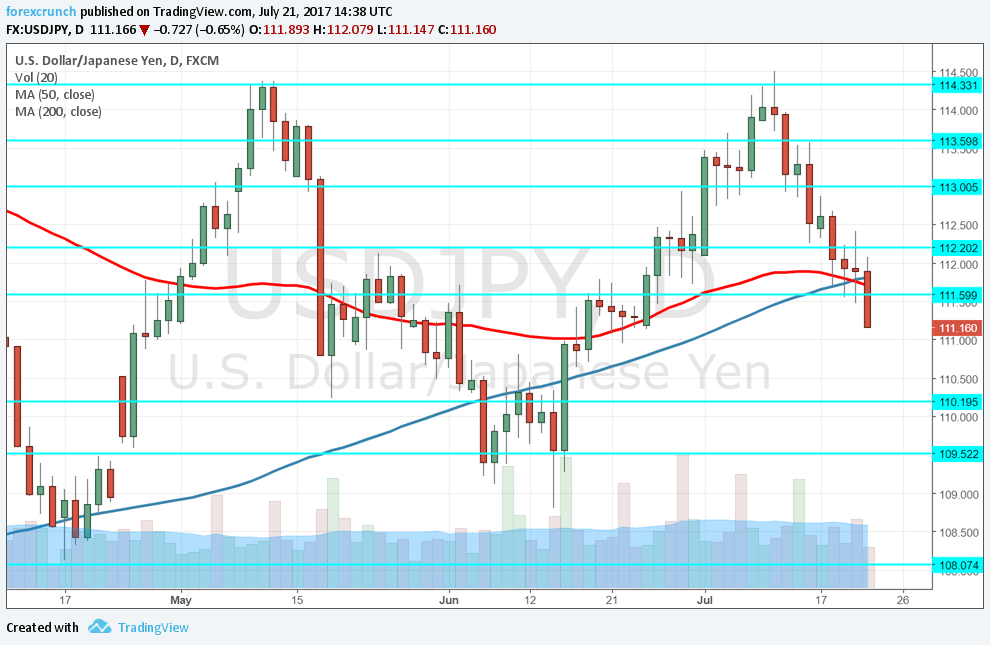

Death cross pattern

The 50-day moving average fell below the 200-day moving average. This is known as a “death cross”. The last time it happened was in December 2015, and the pair plunged from around 122 to under 100.

USD/JPY Sentiment

I remain bearish on USD/JPY

Both the technical loss of the support line and the not-so-great US data point to further falls. The Fed could find it hard to express confidence that weak inflation is transitory but rather related to automation, disruption and other factors.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum