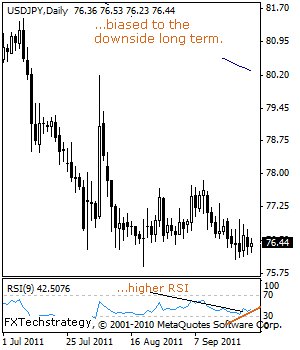

USDJPY: Bearish Theme Remains Intact

USDJPY: Though narrow range candles are now seen which are signs of consolidation, our bearish view on USDJPY remains intact for an eventual return to the 75.92 level, its 2011 low and beyond.

Guest post by www.fxtechstrategy.com

USDJPY has been under a strong bear pressure since topping out at the 124.13 level in Jun’2007 and with that downtrend remaining intact, a convincing violation of the 75.92 level will set the stage for further weakness towards the 74.00 level.

Further down, support stands at the 73.00 level and then the 72.00 level, representing its psycho level. Its daily RSI is bearish and pointing lower suggesting further weakness.

Alternatively, the pair will have to break and close above the 77.85/80.19 levels, its Aug 04’2011/Sept 09’2011 highs to end its bear threats and create scope for further gains towards the 81.47 level, its July 08’2011 high and subsequently the 82.21 level.

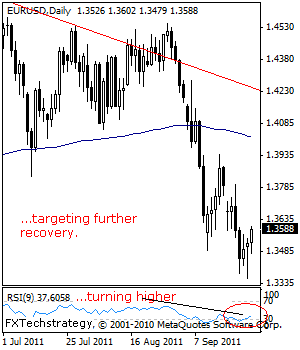

EURUSD: Rejects Lower Level Prices, Target Higher Prices On Correction.

EURUSD: With the pair rejecting lower level prices to close slightly higher on a hammer-like candle pattern on Monday and following through higher in today’s trading session, risk of further recovery is now building up.

If this is fully triggered, EUR should take back some of its recent losses and possibly target the 1.3799 level, its Sept’2011 high.

A break through here will expose the 1.3936 level, its Sept 09’2011 high where a halt is likely to occur and turn the pair back down.

Alternatively, a return below the 1.3362 level, its Sept’2011 low will call for further weakness towards the 1.3245 level, its Jan 17’2011 low. Further down, support comes in at 1.3088 level, its Jan 11’2011 low.