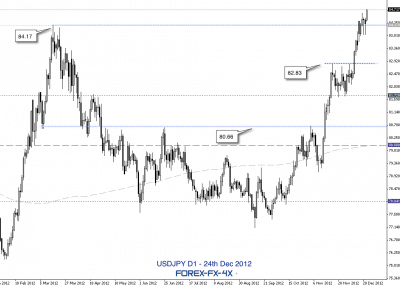

Dollar yen has seen a continuation of the strong upside trend, today breaking above the recent consolidation phase highs, after a choppy period of trading around the 84.17 15/3/12 swing extremity.

Guest post by Nick Simpson of www.forex-fx-4x.com

This culminated in an inside day breakout today during thin holiday period trading conditions.

A minor support zone had formed around 83.84 after price could not break through this area on two recent downside attempts.

Price is now close to the 85.00 psychological round number area, with the 85.51, April 2011 swing high just above. A move above this area would see the dollar/yen trading at a levee; not seen since around September 2010.

Any corrective move lower brings the following potential support areas into focus as per the attached chart: recent 84.17 area resistance highs, 82.83 area previous box resistance range highs.