Expectations for helicopter money hurt the yen. Is the BOJ about to shower the cash? Or will they disappoint once again? The team at Barclays picks the latter and explains below. We think they could wait for after the elections in the US:

Here is their view, courtesy of eFXnews:

In the near term, we expect USDJPY to trade around the upper end of the recent range going into this month’s BoJ meeting as markets speculate on helicopter money and the BoJ moves toward a new round of easing at its end-July meeting. While we think some of this expectation is in the price, there is potential for more short-term upside in USDJPY, especially if risk appetite does not deteriorate in the near term.

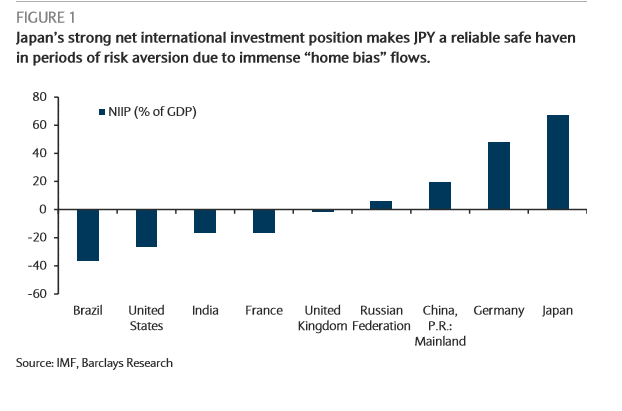

However, we believe the three fundamental pillars of our case for JPY appreciation remain solid: 1) significant undervaluation that is at odds with Japan’s relative cyclical position; 2) the abatement of the forces that led to that undervaluation; and 3) the portfolio insurance value of long JPY amid near-zero interest rates across the G10.

Brexit, European political concerns, the US elections, and late-cycle earnings risks amid stretched asset valuations only amplify our sense of fundamental JPY value.

While PM Abe’s election victory raises the medium-term risks of a blurring of the lines between fiscal and monetary policy, we do not see “helicopter money” as a reality; hence, we continue to view policy as constrained in deterring JPY strength.

Nevertheless, the Abe government’s possible abandonment of its commitment to fiscal consolidation, amid a hyper-accommodative BoJ and an economy with a positive output gap, raises the risks of a policy error, reducing the risk-adjusted medium-term attraction of long JPY.

As such, we see good opportunities to re-engage in long JPY trades versus both USD and EUR.

From technical perspective, we see a longer-term bullish JPY technical trend. In particular, the bearish monthly cloud break in EURJPY has been a reliable downside indicator since 1980 and reinforces our bearish view, which initially targets 106.00, then lower toward 87.50. We expect a downside squeeze in USDJPY toward 93.80 and then 90.50

Barclays targets USD/JPY at 92 by the end of Q3 and 87 by the end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.