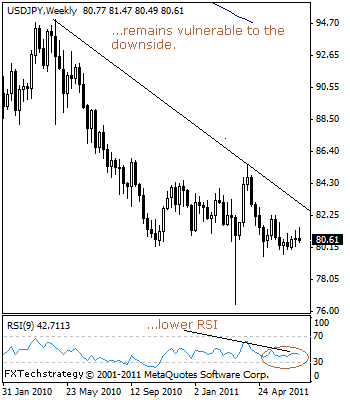

USDJPY: Vulnerable To The Downside Long Term.

USDJPY: With attempts on the upside continuing to falter, the risk remains lower in the long term. With that said, further weakness is expected towards the 79.57 level, its May 05’2011 low on continued upside failures.

Further down, support lies at the 78.00 level, its psycho level and possibly lower towards the 76.18 level, its 2011 low.

Guest post by www.fxtechstrategy.com

Alternatively, a break and hold above the 81.27 level, its Jun 28’2011 high must occur to put its downside vulnerability on hold and then aim at the 82.21 level.

Further resistance stands at the 83.27 level, its April 18’2011 high and subsequently the 85.49 level, its April’2011 high.

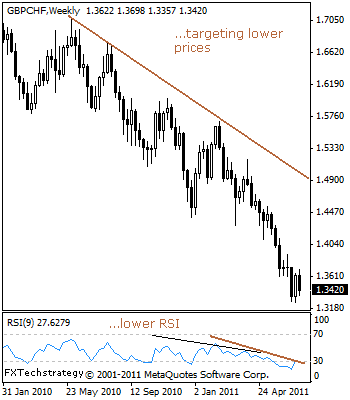

GBPCHF: Loses Upside Momentum, Risk Builds On 1.3260 Level

GBPCHF – With the cross reversing most of its corrective gains the past week, risk of further weakness in the coming week is expected.

In such a case, its year-to-date low at 1.3260 will be targeted with a break and hold below there allowing for further weakness towards the 1.3200 level and then the 1.3100 level, all representing its psycho levels.

On the other hand, a climb back above the 1.3698 level, its July 04’2011 is required to annul its present downside pressure and then open the door for more upside gains towards its Jun 20’2011 high at 1.3736.

Further out, a decisive clearance of there will call for further strength towards the 1.3905 level, its Jun 15’2011 high with a turn above that level setting the stage for further strength towards its May 31’2011 high at 1.4119.

A cap is likely to occur and turn the cross back down in the direction of its primary trend if the 1.4119 level is tested.