- VeChain price is facing significant selling pressure in the short term.

- The TD Sequential indicator has just presented a strong sell signal on the daily chart.

- VET does not have substantial support on the way down.

VeChain price is up by 70% in the recent two weeks, hitting a new all-time high of $0.147 on April 10. However, the digital asset seems poised for a correction after such a colossal rally.

VeChain price faces significant selling pressure

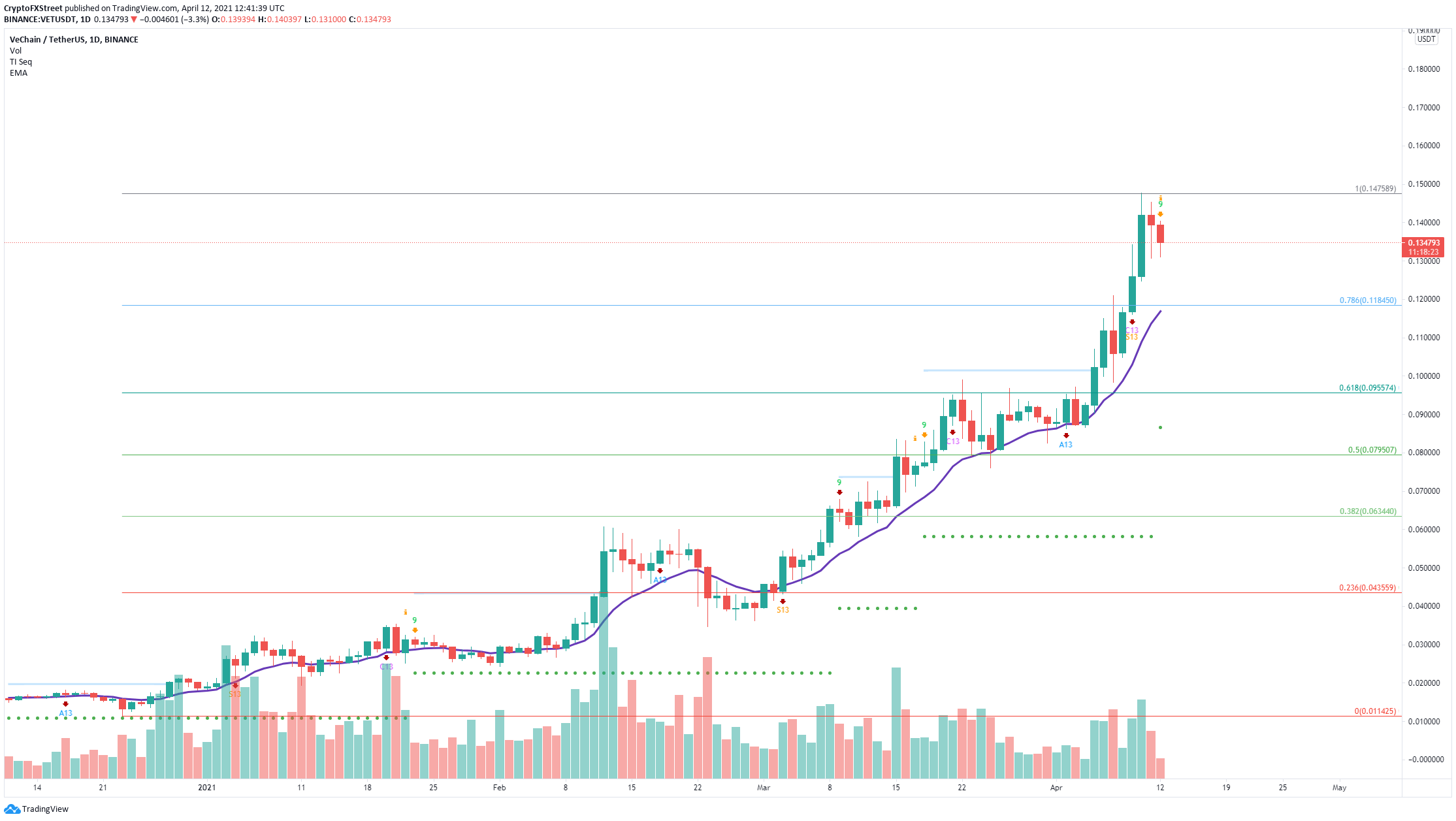

On the daily chart, the TD Sequential indicator has just presented a sell signal in the form of a green ‘9’ candlestick. VET is bound for a correction after a massive 70% rally in the last two weeks.

VET/USD daily chart with 12 EMA

The nearest support level and bearish price target is $0.118, which is the 78.6% Fibonacci retracement level. This level also coincides with the 12-day EMA, a strong support level that has buttressed VeChain price since March 2.

Losing this critical support point has the potential to drive VeChain price down toward the 61.8% Fibonacci retracement level at $0.095.

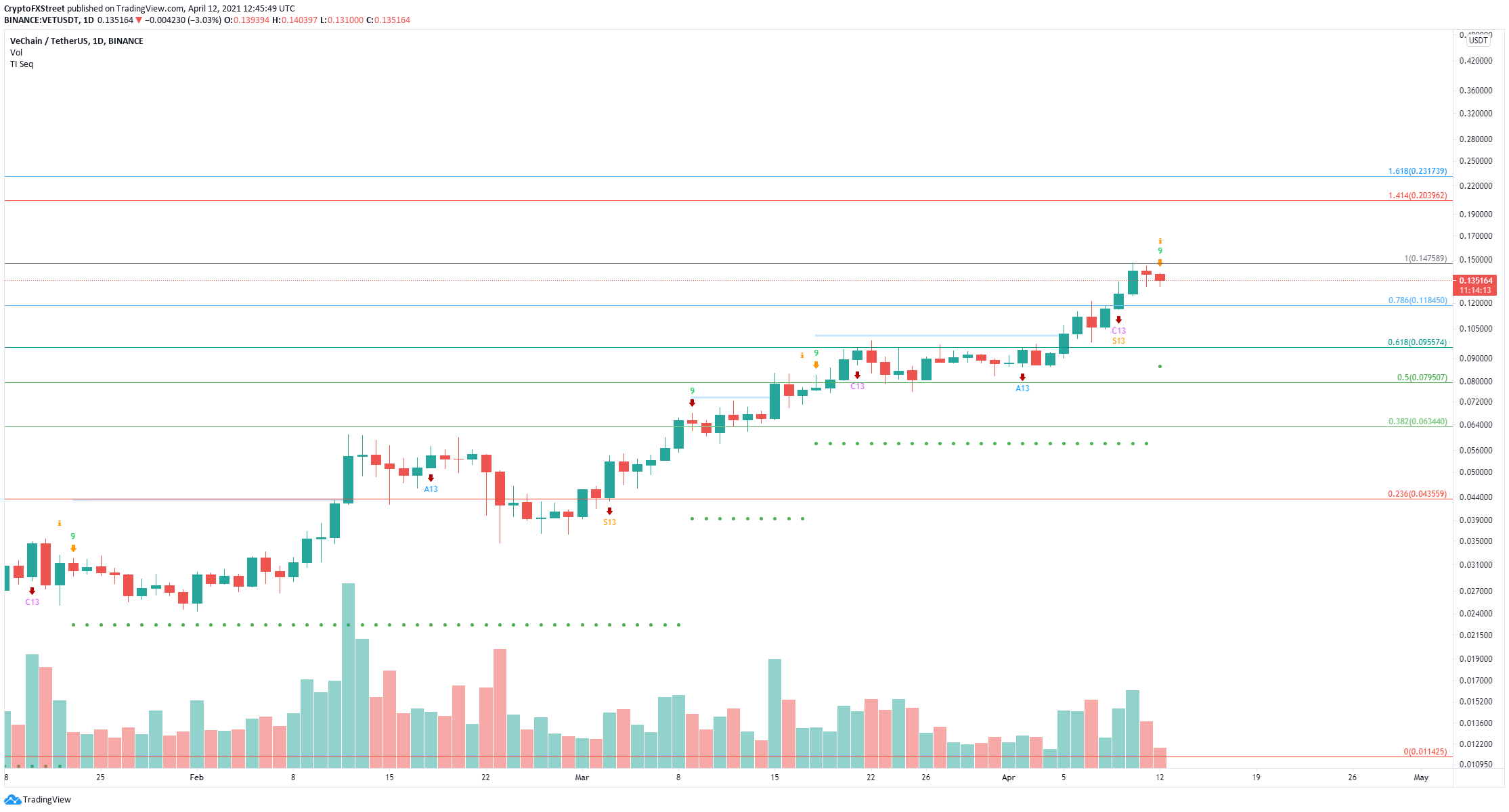

VET/USD daily chart

However, given the recent bullish momentum, there is still a chance for buyers to invalidate the sell signal. A breakout above the previous high of $0.1478 would be enough and can drive VeChain price toward $0.20 at the 141.4% Fibonacci level, as there is practically no resistance ahead.