- The VIX is 2.83% lower on Tuesday testing 0.30 to the downside.

- The 200 Simple Moving Average is also being tested.

Fundamental backdrop

All of the major indices are trading higher on Tuesday with the Nasdaq outperforming 1.29% higher. There was a risk supportive headline in the US session as the WSJ reported that the Fed is keeping its options open on yield caps but will look at other tools first. If the Fed suppresses yields then the market participants will have no choice but to look for gains in the equities markets. At least that is the theory. The Fed is set to release the latest meeting minutes on Wednesday so it will be sure to be an interesting read.

It hasn’t all been positive as Dr Fauci says the US is moving in the wrong direction in regards to the coronavirus pandemic. Dr Fauci is the director of the National Institute of Allergy and Infectious Diseases. He has been very vocal during the COVID-19 pandemic and provided the government with advice on how to deal with the issue.

Fed’s Williams also confirmed the Fed’s stance on negative interest rates saying there is no need at the moment. Unlike the UK who have not ruled out moving rates into negative territory like the ECB, SNB and BoJ.

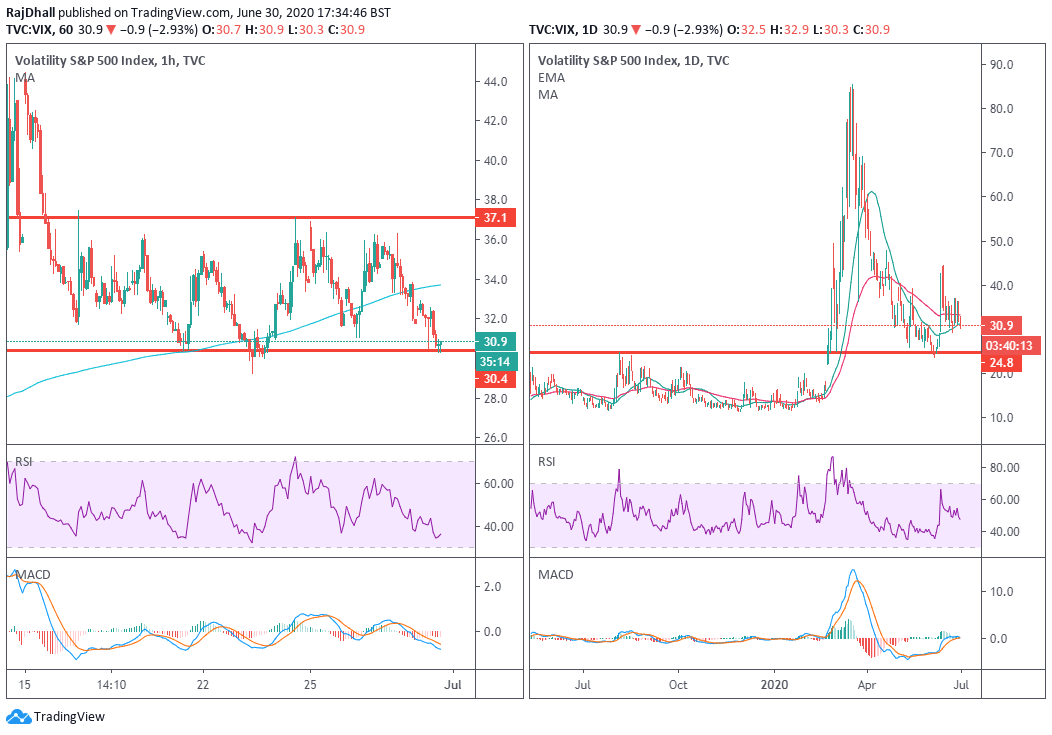

VIX 1-hour (left) and daily chart (right)

As you can see from the hourly chart on the left the VIX is testing the consolidation low. The 0.30 level has been a good support level for some time now and if equities keep moving higher the market could see a break this week. On the daily chart on the right, it is clear that the price is testing the 200 Simple Moving Average and could break lower today.

The daily chart is important as it shows how high the VIX currently is in comparison to traditional levels. The red support line at 24.8 could be a target as anything below there could mean more upside in the equities markets.