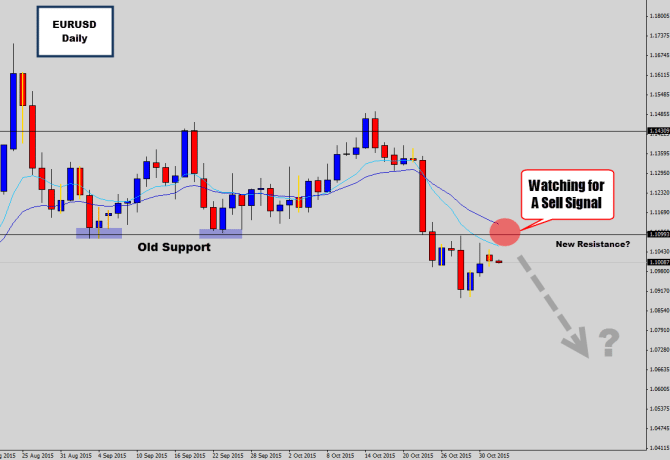

After the Fed baited the market on with more of their ‘we might raise interest rate’ B.S. – we seen volatility pick up on EURUSD and a breakout of the ranging market structure it was stuck it.

Breakouts like this are a breath of fresh air for swing traders – as they can be the beginnings of large broader moves.

There are two ways this could play out in our favor. The first scenario is price will move up and re-test the old consolidation support level, and confirm it is holding as new resistance by printing a large bearish price action reversal signal – such as a bearish rejection candle. This would be the golden scenario, as it would provide a very good entry price into the emerging down move.

Secondly – we actually have an inside day that is very close to the turning point on the chart here. We could see the lows breached and fuel a bearish breaking, kicking off a move that way.

I always advise to take breakouts only when they occur in the London session, when the money is behind the move. This strategy helps avoid getting caught in breakout traps.