- Nasdaq Composite retreated 2.8% to end around 8,966.

- S&P 500 SPX, -3.03% slid 3% to end around 3,128.

- The Dow Jones Industrial Average, DJIA, lost 879 points, or 3.1%, to finish near 27,082.

US benchmarks fell in a back-to-back loss on Tuesday, bringing back memories of the 2018 routs as the coronavirus outbreak sends investors to the sidelines and US health officials announce that a pandemic is likely.

Consequently, as the virus spreads to all corners of the world, the Nasdaq Composite retreated 2.8% to end around 8,966 and the S&P 500 SPX, -3.03% slid 3% to end around 3,128. The Dow Jones Industrial Average, DJIA, lost 879 points, or 3.1%, to finish near 27,082, based on preliminary estimates. The blood bath follows the Centers for Disease Control announcing that Americans should start preparing for potential disruptions due to the coronavirus. More on that here:

-

CDC official says believes immediate risk from coronavirus in US remains low

As for yields, the 10-year Treasury note yield dropped to a record low of 1.31%. Oil suffered, with WTI down 1.7%. Interestingly, gold ran into profit-taking, falling 2.3%.

Coronavirus developments continue to dominate headlines, and with more and more estimated impacts on global growth hitting the wires investors are getting increasingly nervous.

“This devastating situation is evolving rapidly, with cases outside of China firmly in the spotlight. The potential economic impacts remain highly uncertain. Reduced trade and people flows, workplace absenteeism, supply chain disruption, and the impact on consumer and business sentiment are all going to weigh on growth,” analysts at ANZ Bank explained.

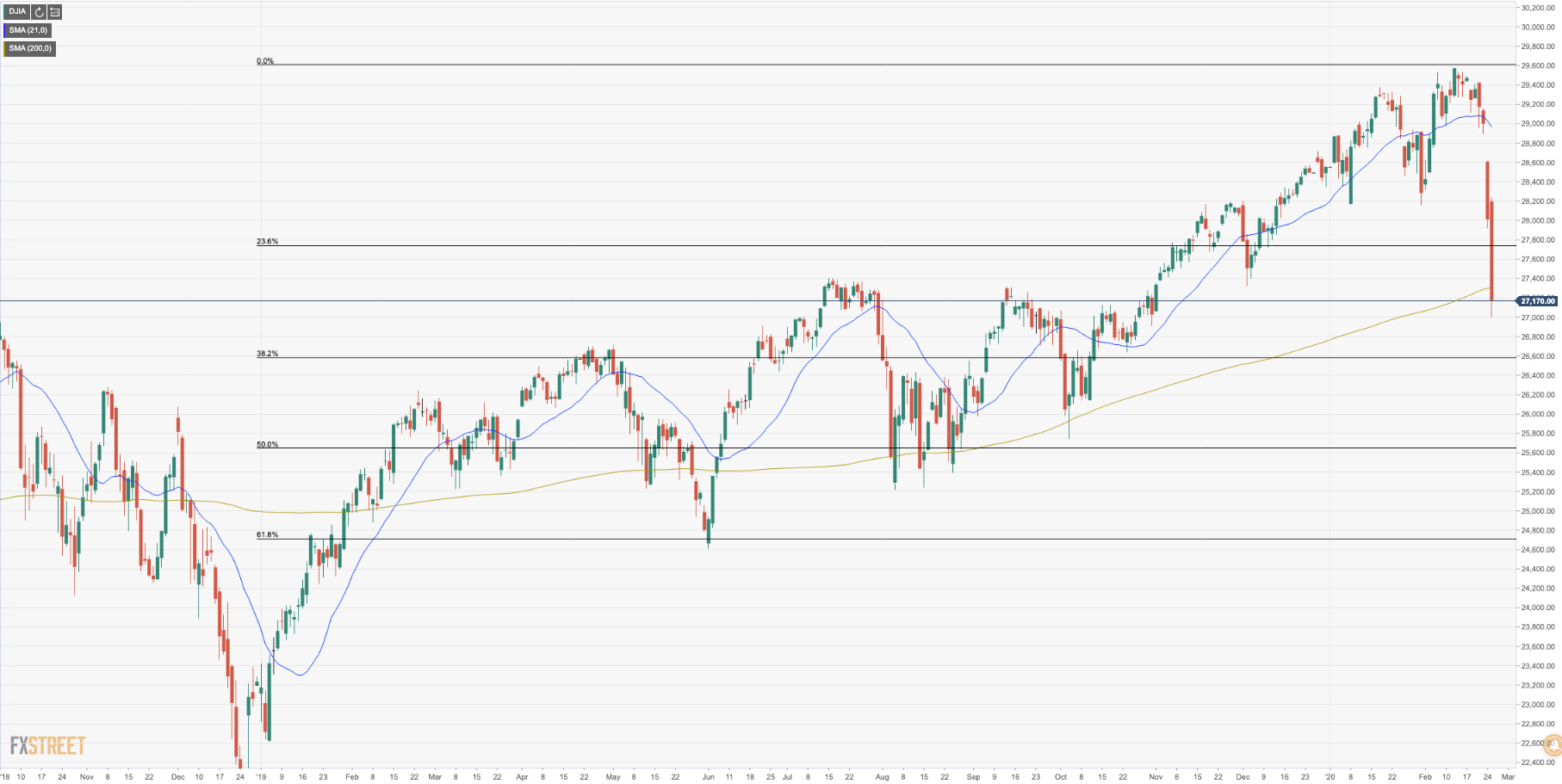

DJIA levels

The index is en-roue to the 38.2% Fibonacci level having penetrated below the 200-DMA.