- The Dow Jones Industrial Average lost 101.78 points.

- S&P 500 index was off 23.10 points.

- The Nasdaq Composite Index lost 90 points.

US benchmarks ended lower on Thursday as investors weighed the balance between trade wars piping up and economies getting back to work, despite the prospects of the second wave of COVID-19. At the same time, there were 2.4 million job losses on the week, turning the screw in the face of a protracted recession. Fed speakers were also somewhat optimistic although aired a cautionary tone.

US initial claims rose 2.44m in the week ended May 16, although that was incorrectly overstated by 1 million in the Massachusetts data. Nevertheless, the data brought the total number of job losses associated with the crisis to 38m.

“The demand shock is enormous,” analysts at ANZ proclaimed.

It is difficult to see a lot of these jobs reopening quickly. Leisure, hospitality, accommodation services, retail – the sectors where the majority of job losses have been concentrated – have a bleak outlook, and Trump-China tensions (with Hong Kong’s planned crackdown on protests a new sticking point) won’t help employer sentiment.

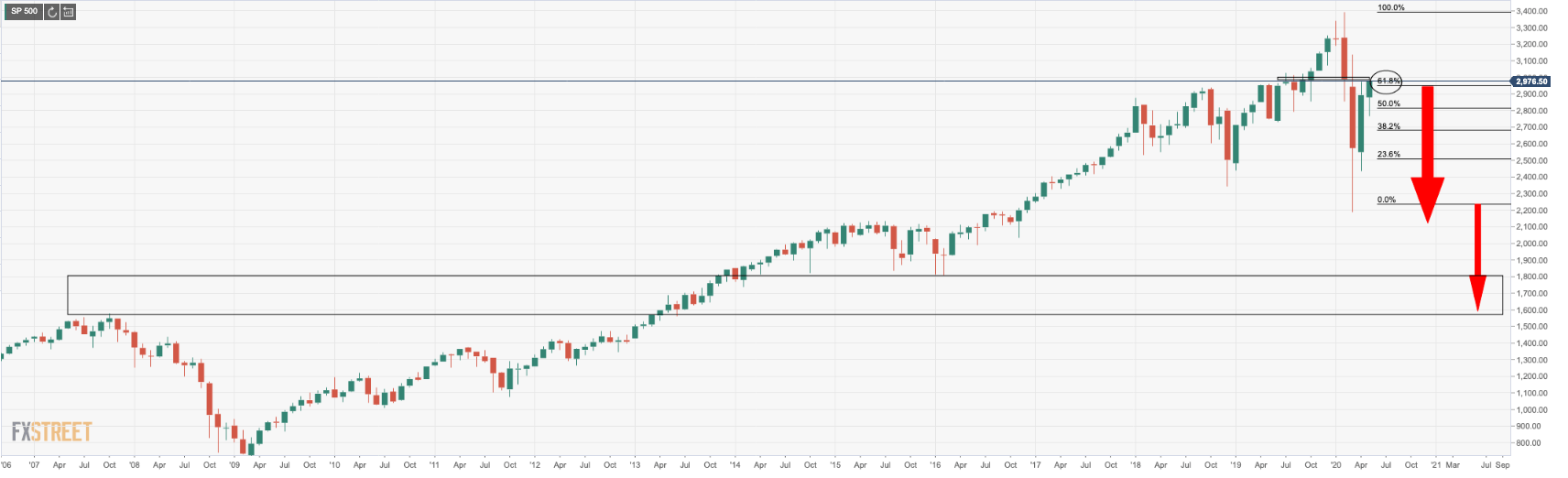

However, so far we are looking good for a positive close this week. All three of the major benchmarks are on track for weekly gains of around 3%, with the S&P 500, up 3%, and Dow, rising 3.3%, on pace for their best weeks since the week ended April 8. For the session, the Dow Jones Industrial Average lost 101.78 points, or 0.4%, at 24,474.12, while the S&P 500 index was off 23.10 points, or 0.8%, at 2,948.51. The Nasdaq Composite Index lost 90 points or 1% to end at 9,284.88.

Overall, there is a cautionary tone in the markets. More on that here: Global COVID-19 update: Global cases surpass 5 million, financial markets taking it in their stride

For the day specifically, the news centred around trade wars. US-Sino tensions continue to boil, sapping some appetite from risk assets. China has warned that US measures and sanctions would result in counter-measures. The Global Times wrote

China never starts trouble and never flinches when trouble comes its way. China will firmly defend its interests if the US does things that undermine China’s core interest: NPC spokesperson.

Key notes

-

Federal Reserve Chairman Powell: Believes that the economy will recover but it will take time

-

US President Trump: There is a lot of ammunition left from Fed and Treasury to help the economy

-

Fed’s Bostic: Going to see a muted recovery – Not a big fan of negative rates

ANZ commentary

This brings us to worry about what it means for the world economy, PMIs and jobs in particular when coupled with the COVID-19 pandemic.

“With the low point in the COVID-19 crisis now past us, interpreting the data will be tricky, especially forward-looking data like diffusion indices, which most PMI surveys tend to be. Having hit “as bad as it can get” lows or thereabouts, they are starting to turn, as is the level of activity,” analysts at ANZ Bank commented.

Ordinarily, expansionary PMIs mark very good news, but expansions off extreme lows need to be read very carefully and after such a sharp drop in activity, we need to keep an eye on levels too. Labour markets tend to lag the rest of the economy and that’s where a lot more of the pain will linger for longer. Anyway, the good news is that we’re likely past the activity lows.