- The three main US indices dropped on Tuesday as investors are afraid that the Italian political turmoil crosses the Atlantic and affects the US economy and even the Fed decision on rates.

- New elections in Italy are set to take place in late July leading to more uncertainties until a new government is formed.

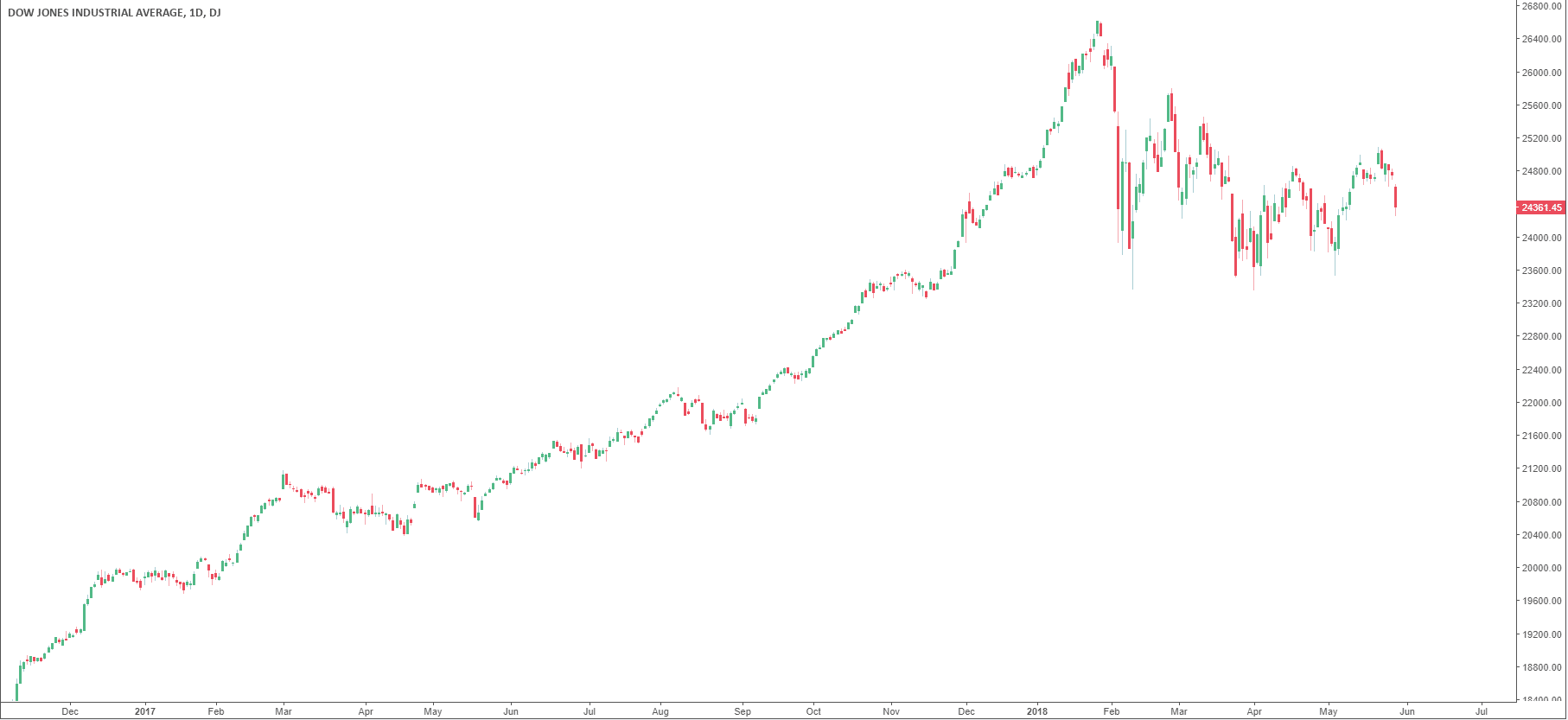

The S&P 500 dropped 1.16% to 2,689.86 while the Dow Jones Industrial Average fell 1.58% to 24,361.45. The Nasdaq Composite Index lost 0.5% to 7,396.59.

The two anti-establishment parties in Italy, the Five Star Movement and the League had chosen eurosceptic Paolo Savona as finance minister. However, Sergio Matarella rejected him and appointed Carlo Cottarelli, a former IMF (International Monetary Fund) official in order to form a temporary government. As a result, the anti-parties abandoned the coalition project and new elections are now expected on July 29.

Analysts argue that it is unlikely that the Eurozone third-largest economy will leave the Euro currency. However, political uncertainties can slowdown European economic growth.

“This could be the straw that breaks the camel’s back in the case of prospects for Europe. It will spill over into the US. They won’t buy as many of our imports,” said Chris Rupkey, chief financial economist at MUFG Union Bank.

“When world economic growth has been threatened in the last three years, it was a concern. It hurts confidence on the economic outlook for the US. Given what we know right now, I would not be comfortable rushing out and forecasting a rate hike in September,” added Rupkey. “It’s not a full-blown European sovereign debt crisis yet. For one thing, the Italian 10-year yield is a little over 3%. Back in 2012, it was at 8%. It’s not the same situation yet. I’m sure many American traders wish that Europe, in general, would stop having these mini referendums on whether the euro is going to survive,” Rupkey added. “It’s going to be really dragged out. I don’t think we can trade on this every day. I don’t think 10-year yields in Italy are going to go higher and higher every day, waiting for that vote. The focus is going to shift back pretty quickly to the US, which is employment and wage data on Friday.”

“The chaos in Europe is pushing down US interest rates so money is flowing to the US, fleeing Europe, making people think, that with falling interest rates, coupled with the rising dollar, that the Fed responds by maybe having second thoughts about the trajectory of Fed policy,” said Marc Chandler, head of forex strategy at Brown Brothers Harriman. “It also is a risk to the real economy because Europe’s a big trading partner.”

Dow Jones daily chart