- MI Inflation Gauge: Monday, 1:00. This Melbourne Institute indicator measures inflation on a monthly basis. In February, inflation fell by 0.1%, its first decline since January 2019. We now await the March data.

- AIG Services Index: Monday, 22:30. The index continues to slow, and has been in contraction territory for the past three months, with readings below the 50-level. The indicator fell to 47.0 in February, down from 47.4 points. Another contraction is likely in March.

- Trade Balance: Tuesday, 1:30. Australia’s trade surplus fell for a second straight month, dropping to A$5.21 billion in January. Still, this was higher than the forecast of A$4.80 billion. Analysts are braced for a sharp drop in the trade balance in February, with an estimate of A$3.75 billion.

- RBA Rate Decision: Tuesday, 4:30. The RBA cut the cash rate from 0.50% to 0.25% on March 19, at an emergency unscheduled meeting. RBA Governor Philip Lowe said that the move was aimed at “reducing the economic and financial disruption resulting from the virus”. The bank is expected to maintain the cash rate at 0.25%, so investors will be keeping a close eye on the tone of the rate statement.

- RBA Financial Stability Review: Wednesday, 1:30. The central bank publishes a report on financial stability twice per year. Apart from the assessment on stability, the publication also provides economic figures and may hint about monetary policy.

.

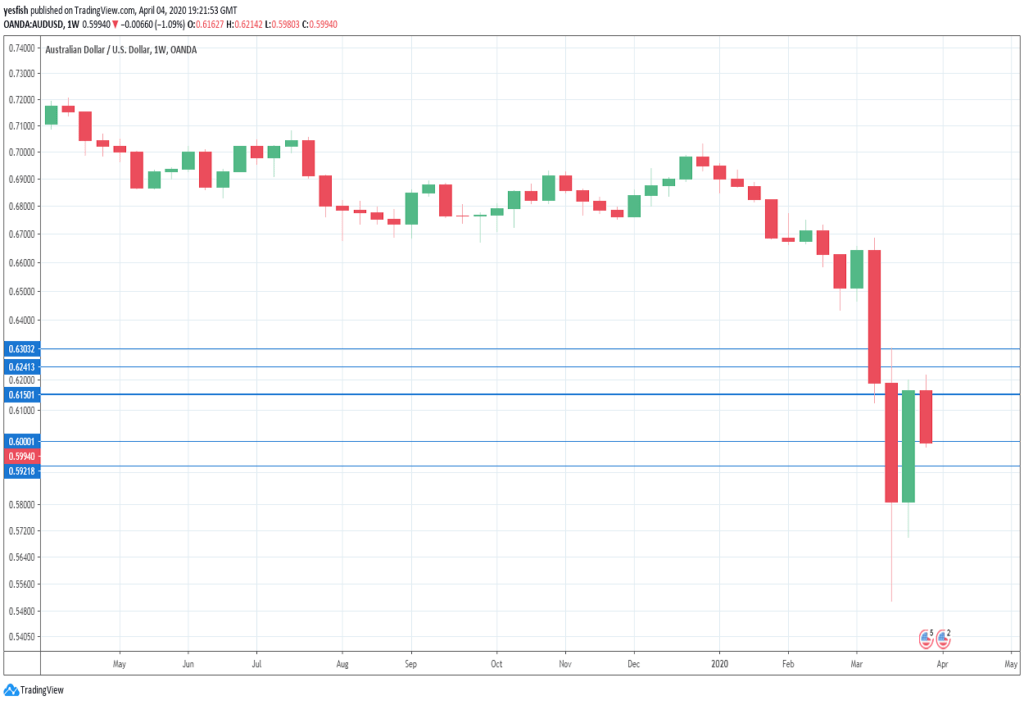

AUD/USD Technical Analysis

Technical lines from top to bottom:

0.6380 (mentioned last week) is next. Until mid-March, the line had held in support since 2009.

0.6240 is next.

0.6150 is an immediate support level.

The round number of 0.6000, which has psychological significance, is next. Currently, it is an immediate resistance line which could see action early next week.

0.5920 is providing support.

The round number of 0.5800 is next.

0.5710 is protecting the round number of 0.5700. It is the final support level for now.

.