The US dollar is having a great October, hitting hard against the pound and pushing the euro out of bed. What’s going on?

Here is their view, courtesy of eFXnews:

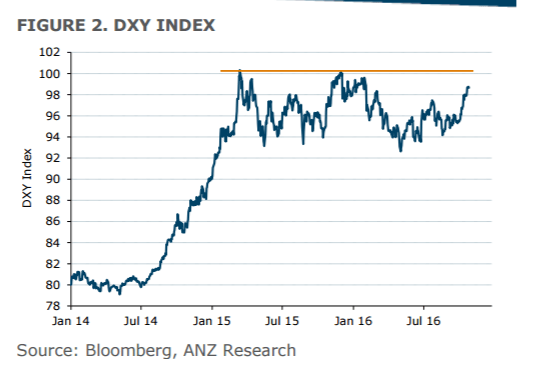

After a period of being range-bound, we have seen a breakout in currency markets, with the USD posting gains. The DXY Index is nearing the important 100 level, which has proven to be a key technical resistance level. Since 2015, the DXY has surpassed that level twice, only for it to retrace lower (see Figure 2). So while that psychological level will remain a magnet for currency markets, it will require a major catalyst to propel the DXY beyond it. We doubt the catalyst will come in the form of the upcoming 8 November US presidential election or even the highly anticipated FOMC meeting on 14 December. The reason being that markets have already largely priced those events in.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Given that expectations – and more importantly, market pricing – is reflecting a Clinton win and a December Fed rate hike, it is hard to see the USD being propelled higher by those alone.

What will give the USD another leg higher are further signs that inflation in developed economies are accelerating. Previously, the absence of inflation has seen major central banks keeping policy very accommodative or pursuing even more aggressive easing. The resultant injection of global liquidity and a low interest rate environment has resulted in a sharp inflow of capital into emerging markets as investors chased yield and moved up the risk curve. But there are signs that the low in inflation has been reached in G7 economies and will start moving higher. Base effects and the rebound in oil prices are partly behind this. Crude oil prices bottomed in January 2016 and have been steadily rising. There is a strong correlation between oil prices and G7 inflation.

Strategic Conclusion:All in all, we see the backdrop as continuing to favour the USD for the time being. Policy divergence certainly remains in favour of the USD, but so too will the shift in the political risk focus towards Europe once the US election is out of the way. Higher inflation in the G7, even if driven mainly by base effects and oil prices, is a significant development that will result in volatility in capital flows. All in all, we continue to expect the USD to fare well.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.