Eurozone flash CPIs/ GDP estimate overview

Eurostat will publish the Eurozone’s inflation first estimate for July at 09.00 GMT today. Consumer prices are expected to remain flat at 2.0% on a yearly basis while the core figures are seen accelerating slightly to 1.0% in the reported month.

At the same time, the first reading of the Eurozone second-quarter GDP figures will be reported. The consensus amongst traders expects the bloc’s economic growth to steady at 0.4% inter-quarter in Q2, while on an annualized basis, is expected to drop t0 2.2% versus 2.5% booked last.

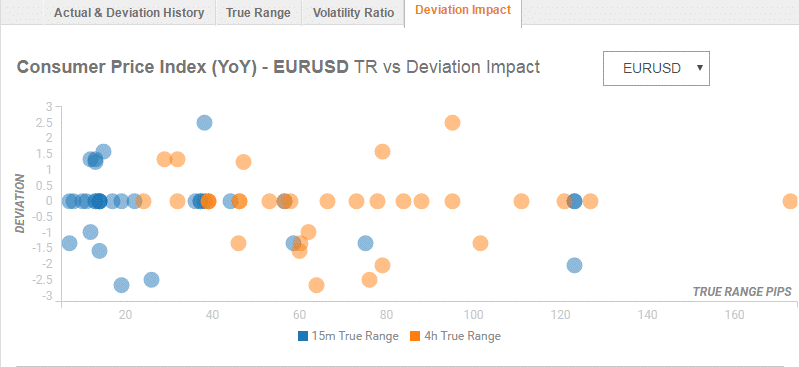

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 40 pips in deviations up to 1.5 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 50 pips.

How could affect EUR/USD?

FXStreet’s Analyst Haresh Menghani explains, “From a technical perspective, the pair has now moved back closer to a short-term descending trend-line resistance, extending from mid-May. A convincing move beyond the said hurdle would negate any near-term negative bias and trigger a short-covering bounce towards monthly highs, around the 1.1790 region. A follow-through buying has the potential to continue lifting the pair further towards the 1.1840-50 heavy supply zone.”

“On the flip side, the 1.1640 horizontal zone now seems to act as an immediate strong support, which if broken might turn the pair vulnerable to break below the 1.1600 handle and aim towards testing an important support near the 1.1540-35 region en-route the key 1.1500 psychological mark,” Haresh adds.

Key Notes

Eurozone: HICP likely to print 2.1% for July – Danske Bank

Eurozone: Focus on inflation and Q2 GDP – TDS

EUR/USD well supported at 1.1700 ahead of CPI, GDP

About Eurozone flash CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).

About Eurozone Q1 Prelim flash GDP

The Gross Domestic Product released by the Eurostat is a measure of the total value of all goods and services produced by the Eurozone. The GDP is considered as a broad measure of the Eurozone economic activity and health. Usually, a rising trend has a positive effect on the EUR, while a falling trend is seen as negative (or bearish).