The German IFO Business Survey/ Lagarde’s speech Overview

The German IFO survey for December is lined up for release later today at 0900 GMT. The headline IFO Business Climate Index is expected to rise slightly to 95.5 versus 95.0 previous.

The Current Assessment sub-index is seen a shade firmer at 98.1 this month, while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to arrive at 93.0 in the reported month vs. 92.1 last.

Ahead of the German data release, the European Central Bank (ECB) President Lagarde is scheduled to speak at 0830 GMT. She is due to deliver opening remarks at the ECB colloquium held in honor of Benoit CÅ“ure, in Frankfurt.

The key theme of the conference is “Monetary policy: the challenges ahead and will be closely eyed by the markets. However, Lagarde is unlikely to sound dovish at the event. Former ECB President Draghi is also likely to speak at the central bank’s conference.

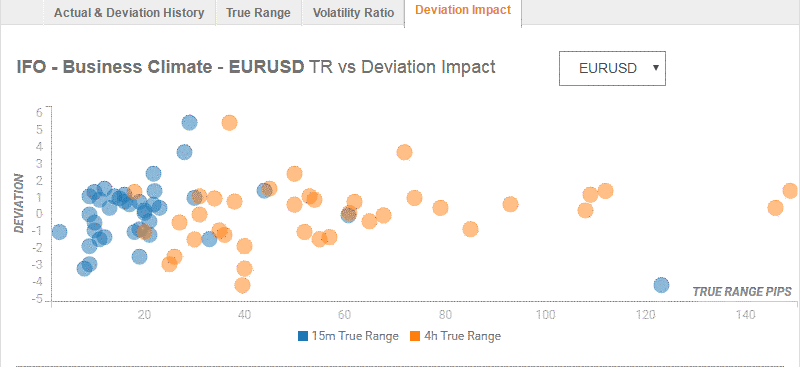

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 40 pips in deviations up to 2.4 to -3.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

According to the AceTrader Research team, “Despite the single currency’s rise to a 4-month peak at 1.1199 on Friday, subsequent selloff to 1.1112 the same day suggests medium-term upmove has made a temporary top there and consolidation with downside bias remains for stronger retracement to 1.1104, then 1.1071, however, support at 1.1041 should remain intact and yield rebound later this week. On the upside, only above 1.1185 would revive bullishness for a re-test of said top, a break would extend uptrend from October’s 2019 trough at 1.0880 to 1.1220/30 later before the prospect of correction.”

At the press time, EUR/USD is seen heading back towards the key 200-day SMA resistance at 1.1153, having found support once again at Tuesday’s low of 1.1129.

Key Notes

Germany: IFO index to underperform – TDS

EUR/USD: Rejected again at 200-day MA, eyes German IFO and Lagarde’s speech

EUR/USD Hourly View

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).

About ECB’s Lagarde

The European Central Bank’s President Christine Lagarde, born in 1956 in France, has formerly served as Managing Director of the International Monetary Fund, and minister of finance in France. She began her eight-year term at the helm of the ECB in November 2019. As part of her job in the Governing Council, Lagarde holds press conferences in detailing how the ECB observes the current and future state of the European economy.