UK September CPI Overview

The cost of living in the UK as measured by the consumer price index (CPI) is scheduled for release this Wednesday at 08:30 GMT. The headline CPI is expected to come in at +0.2% for September as compared to a 0.4% rise recorded in the previous month. Meanwhile, the annualized figure is seen ticking higher to 1.8% from 1.7% previous and the core inflation, which excludes volatile food and energy items, is also expected to have edged up to 1.7% during the reported period.

As Yohay Elam, FXStreet’s own Analyst explains – “there are reasons to believe that the UK inflation may fall short of expectations once again. In the past 12 months, CPI missed estimates six times and beat them only twice. Moreover, prices in the euro-zone – with which the UK still trades closely – dropped in September. Moreover, the broader picture is of a downtrend in annual price development after reaching a peak in late 2018.”

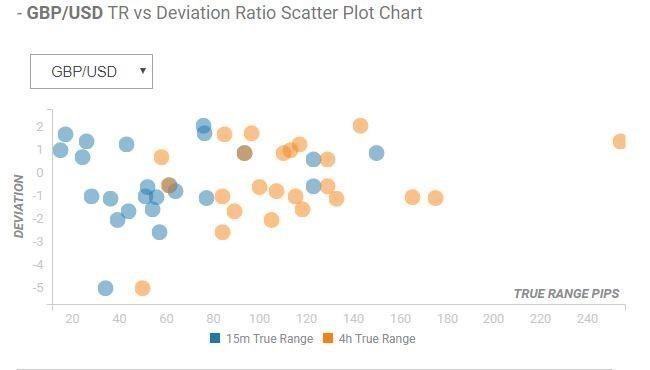

Deviation impact on GBP/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 15 and 80 pips in deviations up to 2 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 120 pips.

How could it affect GBP/USD?

Yohay Elam further provided important technical levels to trade the GBP/USD pair – “The Technical Confluences Indicator is showing that the next upside target for GBP/USD is 1.2841, which is the convergence of the Pivot Point one-week Resistance 1 and the Bollinger Band one-hour Upper. Further up, the cable may hit 1.2902, which is where the Pivot Point one-month Resistance 2 meets the price.”

“Support awaits at 1.2729, which is the confluence of the Simple Moving Average 5-4h, the BB 1h-Middle, and the Fibonacci 38.2% one-day. The next cushion is close – 1.2702 is the meeting point of the previous weekly high, the SMA 100-15m, and the SMA 200-one-day. In case the deal collapses, the next support line is 1.2603, which is where the PP one-month R1 and the previous daily low converge,” he added further.

Key Notes

UK inflation preview: Downside surprise has higher chances and GBP/USD may struggle

GBP/USD technical analysis: Sellers await entry below near-term rising trendline, 200-day SMA

GBP/USD could climb further to the 1.2850 region – UOB

About the UK CPI

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).