The UK manufacturing PMI overview

The UK manufacturing PMI is due for release today at 0830GMT and is expected to show that the pace of expansion in the activity slowed father in May after April’s disappointing figures. The index is expected to arrive at 53.5 versus 53.9 booked previously.

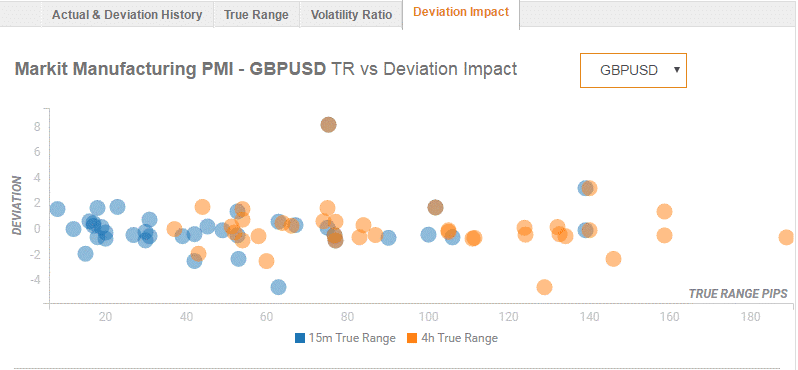

Deviation impact on GBP/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 50 pips in deviations up to 1.65 to -2.50, although in some cases, if notable enough, a deviation can fuel movements of up to 80 pips.

How could affect GBP/USD?

At 1.3270, the pair is seen heading back towards the daily lows at 1.3255. Should the data show a bigger-than-expected drop, the spot could breach the 1.3205 six-month low, below which a test of 1.3150 (psychological levels) becomes imminent. However, on a positive surprise, the GBP/USD pair could attempt a bounce in a bid to regain the 1.33 handle (daily tops), above which next target lies at 1.3320/33 (10-DMA/ classic R1).

However, the reaction to the data is likely to be limited, as the main event risk for today remains the US payroll data, which will provide fresh impetus to the US dollar trades.

Key Notes

GBP/USD Forecast: bearish trend set to resume, UK PMI/US NFP in focus

European FX Outlook: Manufacturing PMI is Europe and NFP in the US headline

UK: Manufacturing PMI likely to print 53.5 for May – Nomura

About the UK manufacturing PMI

The Manufacturing Purchasing Managers Index (PMI) released by both the Chartered Institute of Purchasing & Supply and the Markit Economics captures business conditions in the manufacturing sector. As the manufacturing sector dominates a large part of total GDP, the Manufacturing PMI is an important indicator of business conditions and the overall economic condition in the UK. A result above 50 signals is bullish for the GBP, whereas a result below 50 is seen as bearish.