US April CPI Overview

Friday’s US economic docket highlights the release of the latest consumer inflation figures, due for release later during the early North-American session at 12:30GMT. The headline CPI is anticipated to hold stable at 0.4% month-on-month (m/m) and edge higher to 2.1% yearly rate. Meanwhile, Core CPI, which excludes food and energy costs, is anticipated to rise 0.2% m/m during the reported month, up from 0.1% previous, and also tick higher to 2.1% y/y rate.

As analysts at TD Securities explained: “The main driver behind the monthly gain is another sizable jump in gasoline prices. Furthermore, we anticipate core CPI inflation to register another “soft” 0.2% m/m gain (2.1% y/y), as a firm 0.2% increase in core services prices will likely offset a third consecutive monthly decline in prices in the core goods segment (which we pencil in at -0.1% m/m).”

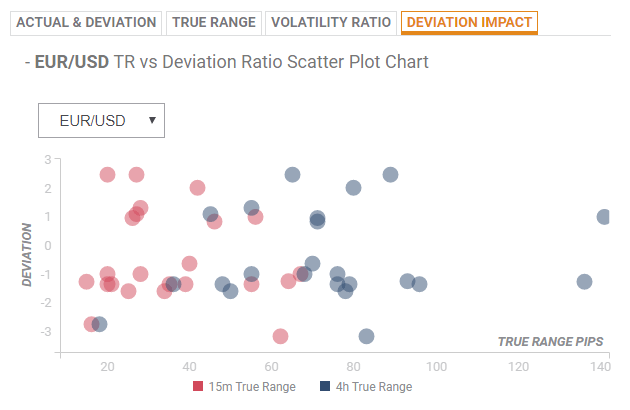

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below and as observed, the reaction in case of a relative deviation of +0.98 to -0.98 in the core CPI print is likely to be in the range of 26-25 pips during the first 15-minutes and could stretch to 55-71 pips in the following 4-hours.

How could it affect EUR/USD?

Yohay Elam, FXStreet’s own Analyst offers important technical levels to watch out for: “Initial resistance awaits at 1.1250 which was the high point on Thursday. It is closely followed by 1.1265 that was a high point in early May and had also served as resistance in April. Another cap is 1.1280 which was a support line in April. 1.1330 is next.”

“Initial support awaits at 1.1210 that was a temporary cap last week. It is followed by 1.1165 that held the currency pair up last week. 1.1135 was a swing low last week, and 1.1110 is the current 2019 trough,” Yohay added further.

Key Notes

“¢ US CPI Preview: Higher is better

“¢ EUR/USD Forecast: 3 reasons why it is rising despite Trump’s new massive tariffs on China

“¢ EUR/USD Technical Analysis: Corrective rebound now targets 1.1260/70 band

About the US CPI

The Consumer Price Index released by the US Bureau of Labor Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).