US jobs report overview

Friday’s US economic docket highlights the release of keenly watched US monthly jobs report, popularly known as NFP. The report is scheduled to be released at 1230GMT and is expected to show that the US economy added 195K new jobs during the month of June.

The unemployment rate is anticipated to hold steady at an 18-year low level of 3.8% and average hourly earnings, which have gained more traction in the recent past, could rise 0.3% m/m and the yearly rate is estimated to edge up to 2.8%.

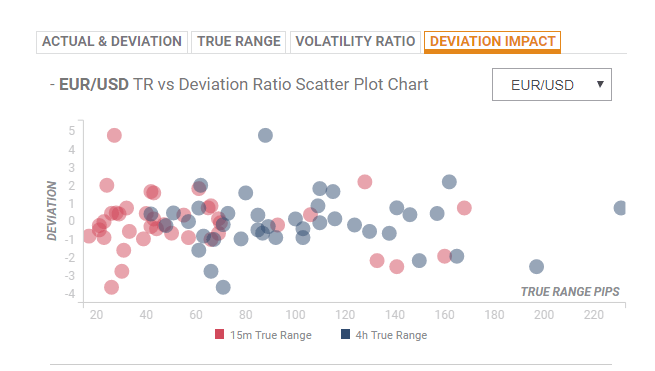

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction in case of a relative deviation of +4.33 or -1.46 is likely to be in the range of 30-41 pips during the first 15-minutes and could stretch to around 64-120 pips in the following 4-hours.

How could the data affect EUR/USD?

Yohay Elam, FXStreet’s own Analyst explains: “1.1720 capped the pair in late June. Higher, the round 1.1800 level separated ranges during June and May. Key resistance awaits at 1.1850, the swing high of June 14th.”

“1.1650 is a pivotal line in recent months, a magnet for the pair. Further down, 1.1615 was a place where the pair paused on its way up. 1.1590 was the low point on July 2nd,” he adds further.

Key Notes

“¢ Nonfarm Payroll preview: tariffs could overshadow employment data

“¢ How to trade the US Non-Farm Payrolls with EUR/USD

“¢ EUR/USD sticks to gains near 1.1715 ahead of US NFP

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure, and therefore market’s reaction depends on how the market assets them all.