US jobs report overview

Friday’s US economic docket highlights the release of keenly watched US monthly jobs report, popularly known as NFP. The report is scheduled to be released at 1230GMT and is expected to show that the US economy added 185K new jobs during the month of September, down from previous month’s upbeat reading of 201K.

Meanwhile, the unemployment rate is seen ticking lower to 3.8% from 3.9% price and average hourly earnings, which have gained more traction in the recent past, is seen rising at a slightly slower pace of 2.8% y/y as compared to 2.9% y/y rate in the previous month.

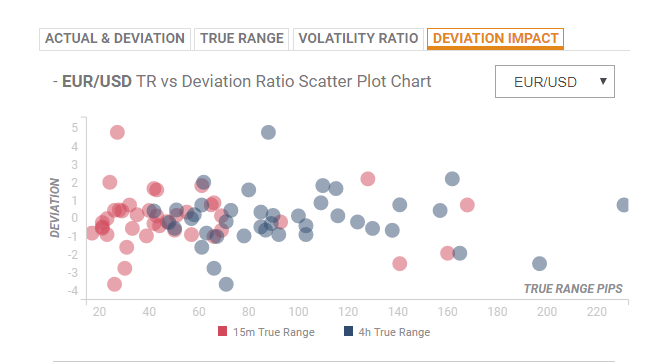

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed, the reaction to the headline NFP print, in case of a relative deviation of -1.23 or +0.98, is likely to be in the range of 54-52 pips during the first 15-minutes and could stretch to 105-90 pips in the subsequent 4-hours.

How could the data affect EUR/USD?

Yohay Elam, FXStreet’s own Analyst explains: If the pair surges above 1.1530, the ambitious upside target would be 1.1640 where we see a congestion including the SMA 200-4h, the SMA 100-one-day, the Bollinger Band one-day-Middle, the Fibonacci 61.8% one-month, the Fibonacci 23.6% one-week, and the Pivot Point one-day R1.

Looking down, we see soft support around 1.1475 which is the confluence of the PP one-day S1, the BB one-day Lower, the BB 4h-Lower, and the PP one-month S1. Lower, weak support is at 1.1415 where we see meeting point of the Fibonacci 161.8% one-day, and the Pivot Point one-week S2, he adds further.

Key Notes

“¢ The Employment Situation Report: Nonfarm Payrolls and Unemployment

“¢ EUR/USD Forecast: Lose-lose situation ahead of the NFP

“¢ EUR/USD Technical Analysis: Remains under pressure and targets 1.1450

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure, and therefore the market’s reaction depends on how the market assets them all.