US monthly jobs report overview

Friday’s US economic docket features the key release of the closely watched US monthly jobs report, popularly known as NFP, and is scheduled to be released at 1230GMT. The US economy is expected to have added 190K new jobs during the month of October, up from previous month’s downbeat reading of 134K, and the unemployment rate is anticipated to hold steady at 3.7%.

The key focus, however, will be on average hourly earnings data, which have gained more traction in the recent past, is seen rising at a slightly slower pace of 0.2% m/m as compared to 0.3% increase in the previous month. Meanwhile, the yearly rate is expected to show a growth of 3.1%, marking the largest annual gains since mid-2009, and further point to labor market tightening.

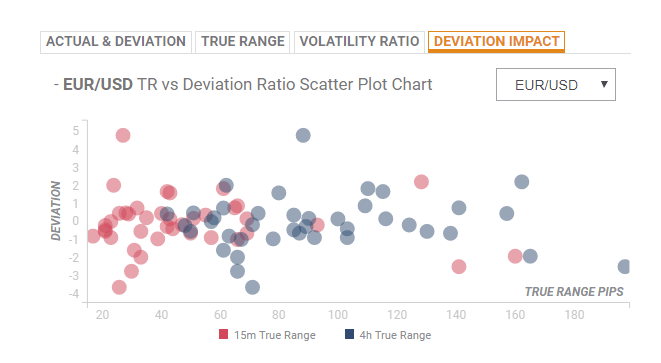

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed, the reaction to the headline NFP print, in case of a relative deviation of -1.23 or +0.98, is likely to be in the range of 54-52 pips during the first 15-minutes and could stretch to 105-90 pips in the subsequent 4-hours.

How could the data affect EUR/USD?

Yohay Elam, FXStreet’s own Analyst writes: “Some resistance awaits at 1.1475 where we see the confluence of the Fibonacci 61.8% one-week, the Simple Moving Average 100-4h, and the Bollinger Band one-day Middle. 1.1503 is another hurdle. We see the Pivot Point one-day Resistance 2 and the Fibonacci 61.8% one-month converge. The ultimate target is 1.1527 which is the meeting point of the Pivot Points one-month R1, and one-week R1.”

“Support awaits at 1.1384 where we see a cluster of lines including the Fibonacci 38.2% one-day, the Bollinger Band 1h-Lower, and the BB 15 minutes Lower. A more significant support line is just above 1.1300, at 1.1306 where we see the confluence of yesterday’s low, the BB 4h-Lower, the PP one-month Support 1, and the BB one-day Lower,” he added.

Key Notes

“¢ Nonfarm Payrolls preview: wages’ growth vs. job’s creation, which one will weigh more?

“¢ US NFP Preview: 7 major banks expectations from November month’s employment report

“¢ EUR/USD Forecast: All aboard Trump’s trade turnaround train, NFP eyed

“¢ EUR/USD moves to session highs above 1.1430, Payrolls eyed

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure, and therefore the market’s reaction depends on how the market assets them all.