- Prices of the WTI alternate gains with losses around $52.00/bbl.

- Easing coronavirus concerns helped crude oil prices last week.

- Attention shifts to the weekly reports by the API and the EIA.

Prices of the West Texas Intermediate are trading within a tight range at the beginning of the week, with the upside capped just above the $52.00 mark per barrel. This area of resistance is coincident with the 21-day SMA.

WTI looks to data, China

Prices of the American reference for the sweet light crude oil appears to have met a strong resistance in the area above the $52.00 mark so far despite concerns over the Chinese COVID-19 continue to diminish and bolster the risk complex.

In addition, traders’ sentiment remains sour following the persistent build in US crude oil supplies, as per latest weekly reports by the API and the EIA.

Also weighing on prices on Monday, the International Energy Agency (IEA) revised lower its forecasts for the demand of crude oil this year, adding that consumption will decrease by more than 400K bpd during the first quarter.

In the meantime, there is still no news regarding a probable extension of the OPEC+ output cut agreement and/or the implementation of deeper cuts, while Russia and the rest of the cartel are still debating the date of the next meeting.

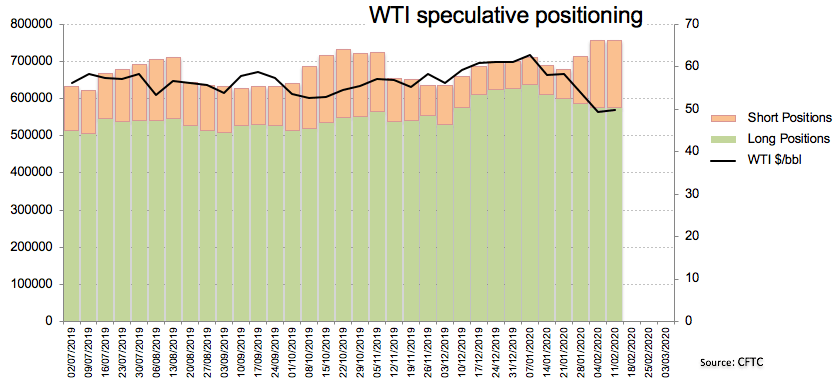

On another front, speculators trimmed their net long positions in crude oil to the lowest level since late October during the week ended on February 11th, according to the latest CFTC report.

Later in the week, the API will publish its weekly report on US crude oil inventories on Wednesday (due to Monday’s holiday) and the EIA is expected to release its report on Thursday.

WTI significant levels

At the moment the barrel of WTI is retreating 0.29% at $52.05 and a breach of $49.31 (2020 low Feb.5) would aim for $42.20 (2018 low Dec.24) and finally $41.83 (2017 low Jun.21). On the other hand, the next hurdle aligns at $52.38 (monthly high Feb.17) seconded by $54.35 (weekly high Jan.29) and then $56.52 (200-day SMA).