- WTI is consolidating the recent series of bullish daily impulses.

- Crude is getting a lift on demand themes into month-end.

West Texas Intermediate spot is currently trading at $66.08 and between a low of $66.09 and a high of $66.16 following a relative,y positive session in New York trade.

US inventories fell more than expected and oil moved a touch higher overnight on demand themes amid signs of stronger demand.

West Texas Intermediate spot ended the day some 0.21% higher at $66.12 after travelling from a low of $65.27 to a higher of $66.40.

Brent settled up 16 cents, or 0.3%, to $68.87 a barrel and WTI settled higher by 14 cents, or 0.2%, at $66.21 a barrel.

Energy Information Agency (EIA) data was showing that crude stockpiles were drawn down by 1,662kbbl last week.

Both gasoline and distillate inventories were lower, falling 1,745kbbl and 3,013kbbl respectively.

The EIA report showed that the rolling four-week average of gasoline supplied topped 9mb/d for the first time since April 2020.

There are expectations of improving demand ahead of the peak summer driving season which is driving prices higher and despite the concerns of more barrels coming on to the market and additional world Iranian supply.

”Longer term, the market is becoming concerned about a lack of investment in new capacity. A Dutch court ordered Royal Dutch Shell to slash its emissions harder and faster than planned,” analysts at ANZ bank explained.

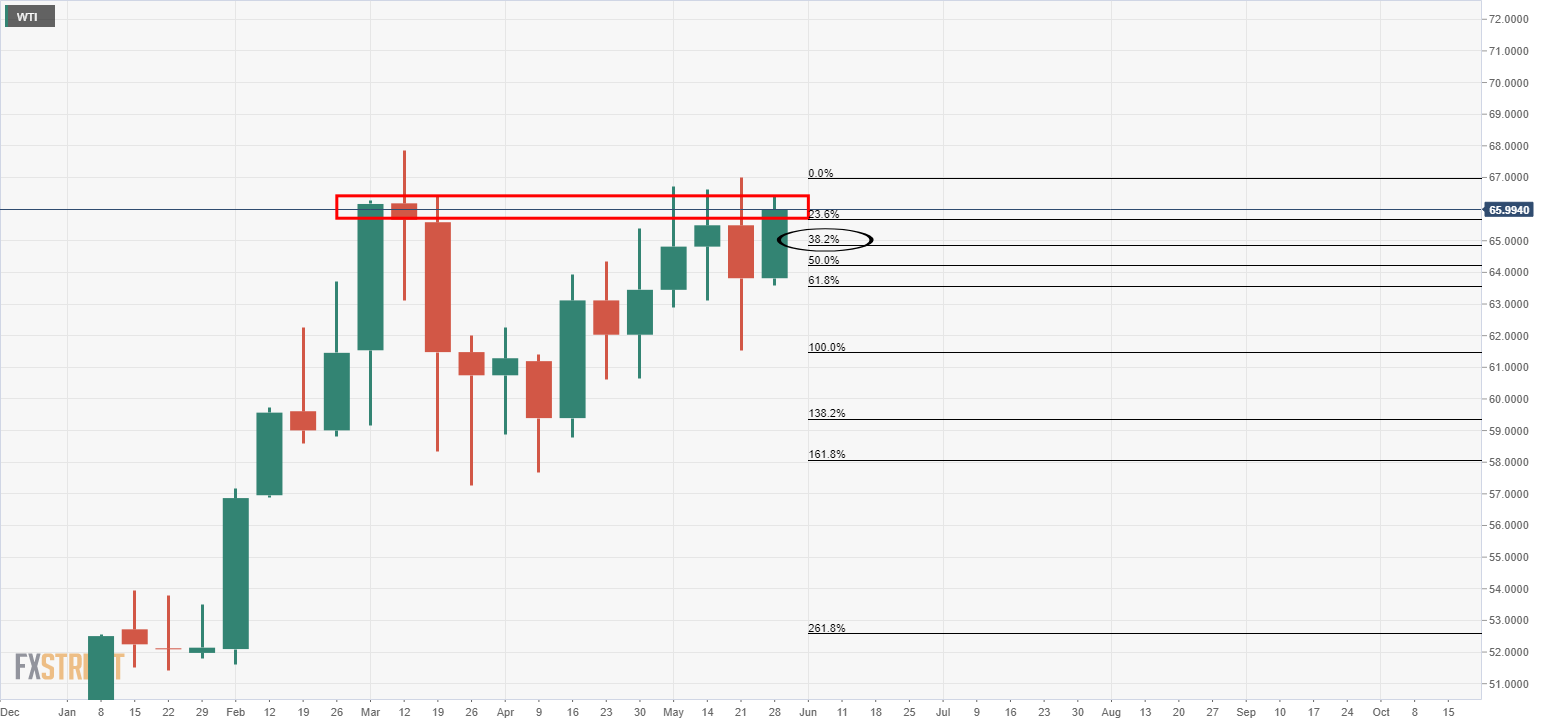

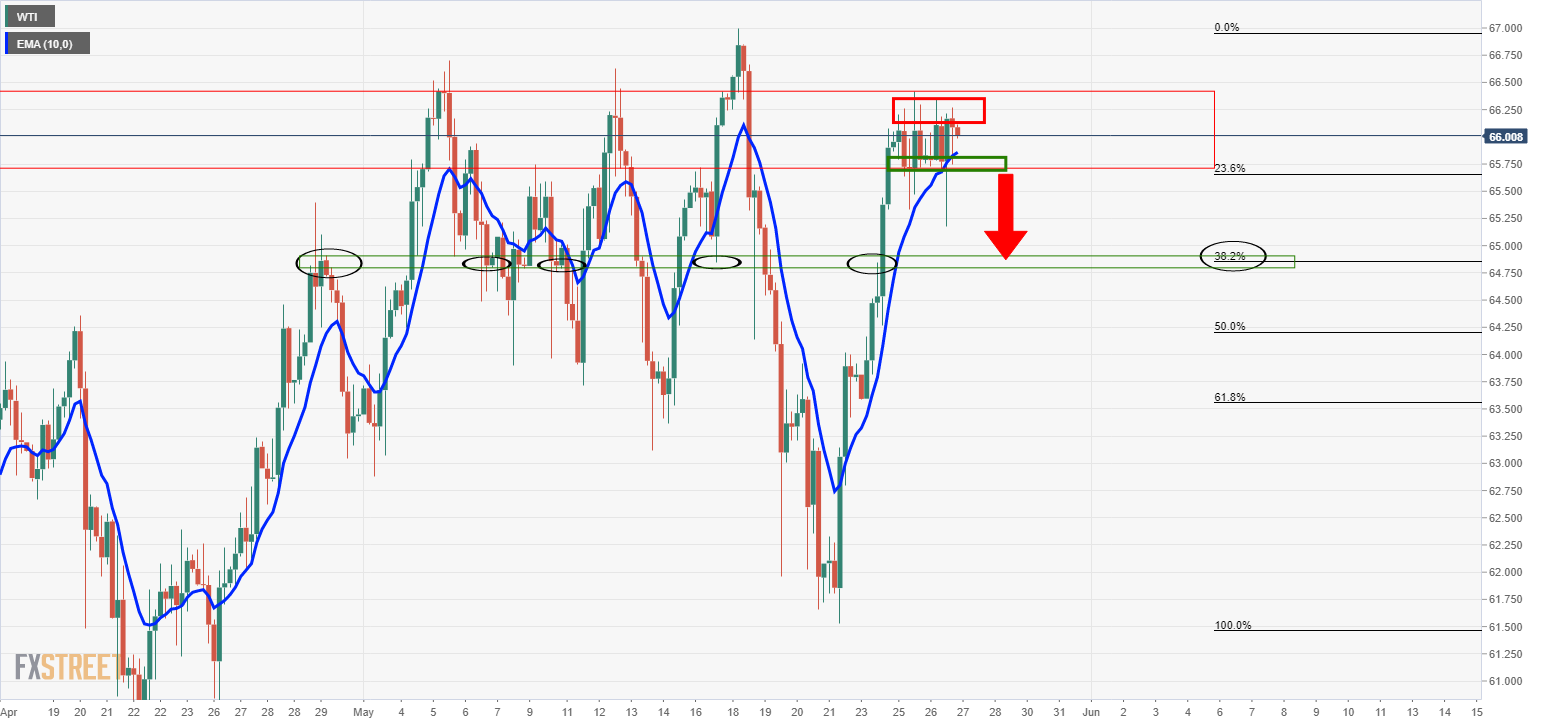

WTI technical analysis

Technically, the price of oil is holding deeper into resistance territory on the daily chart near to the prior highs of 66.99.

A break of that high opens risk to a continuation, but a correction would be expected in the near term.

A 38.2% Fibonacci of the weekly bullish impulse comes in at 64.97 which aligns with the 4-hour structure as follows: