- WTI is back to where it started following an Iran headline influenced drop.

- Technically, the downside is completing for the near-term.

Oil prices were elevated on Thursday with the price of West Texas Intermediate piercing through the psychological $70 mark once again following a day-prior drop after a report showed an unexpectedly sharp rise in US gasoline inventories.

At the time of writing, the price of WTI is trading at $70.11 and higher by 0.55% after recovering from a low of $68.71, albeit off its highs for the day of $70.62.

There was a sharp spike in the late morning of the US session when news that the US will lift oil sanctions on Iran initially sparked a fall in oil prices, but the market recovered with WTI gaining 0.4% to USD70.22/bbl.

The news has rallied speculation of a nuclear deal.

The Wall Street Journal reported that sanctions were lifted on ”more than a dozen former Iranian officials and energy firms, an action that comes amid stalled nuclear negotiations and that US officials say signals Washington’s commitment to easing a broader pressure campaign if Tehran changes its behaviour.”

Reuters quoted Farokh Alikhani, production manager of the National Iranian Oil Company (NIOC), who told the oil ministry’s SHANA website “if sanctions are lifted, most of the country’s crude production will be restored within a month,”

“Careful planning has been done to restore oil output to pre-sanctions levels in intervals of one week, one month and three months.”

Meanwhile, the Energy Information Administration on Wednesday reported that US gasoline stocks rose by 7-million barrels last week, the first week of the US driving season that began on the Memorial Day weekend.

“The rise in gasoline stocks – the most pronounced week-on-week rise since the pandemic-induced increase in April 2020 – … is causing confusion on the market because the main reason for the latest upswing in oil prices was the expectation of a massive surge in (gasoline) demand,” Commerzbank analyst Eugen Weinberg said in a note.

In other events, US Consumer Price Index was the focus.

The CPI rose 0.6%, with core up 0.7%, stronger than expected. Also, the US CPI rose 5.0% YoY which was the largest annual gain in more than a decade

However, the outcome was not entirely a surprise given the potential changes as the economy re-opens and markets appear convinced that the Fed will not change its current view that inflation is transitory when it meets next week.

However, it is expected to revise up its inflation forecast for this year and next which is bullish for oil prices so long s they seem committed to lower for longer rates.

That being said, there could be a hawkish surprise that would be expected to underpin the US dollar for the medium term which is likely to hamstring the price of oil as it becomes more expensive for foreign buyers on foreign currencies.

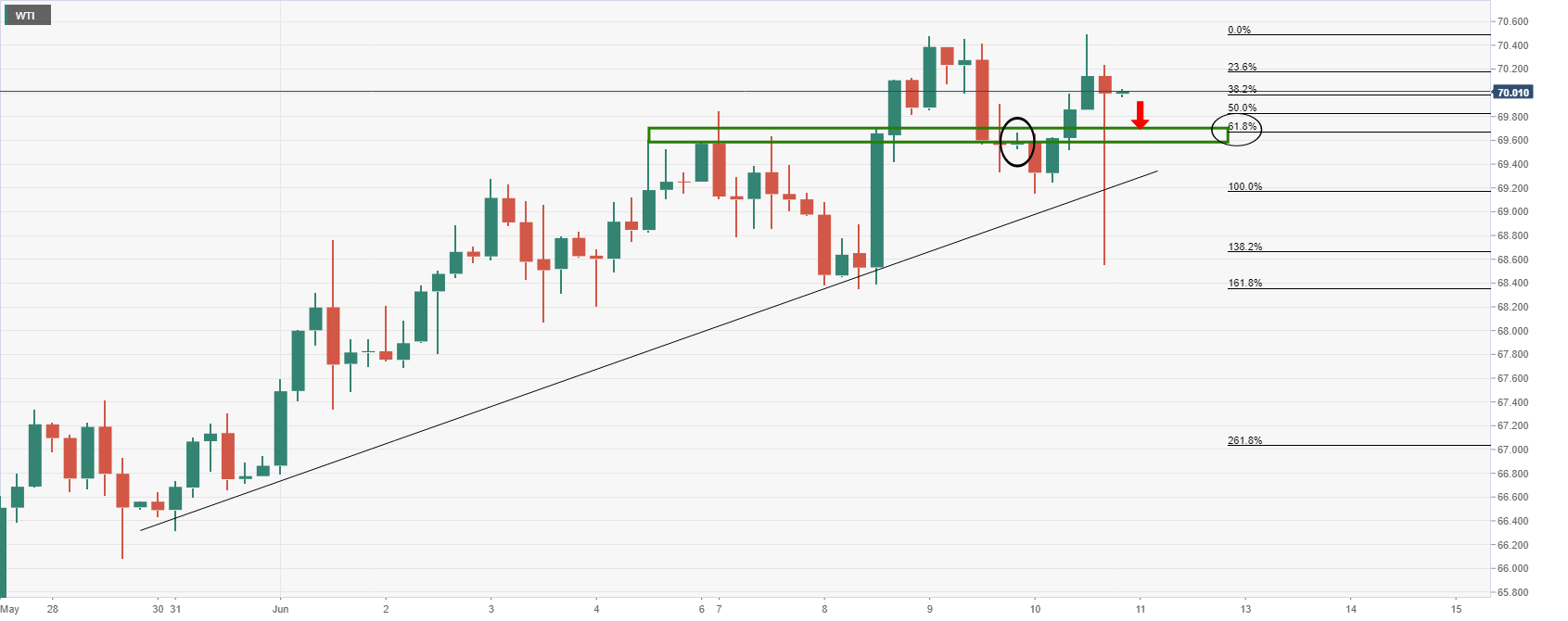

WTI technical analysis

The spike to the downside is compelling according to the 4- hour chart and W-formation.

The neckline of the formation is a target that aligns with the prior resistance looking left and the 61.8% Fibonacci retracement of the 4-hour impulse.