- The barrel of WTI trades with modest gains above $37.00.

- Larger-than-expected US inventories, weak demand weigh on prices.

- US oil rig count by Baker Hughes will close the weekly calendar.

Prices of the WTI are trading on a choppy fashion, alternating gains with losses around the $37.00 mark per barrel at the end of the week.

WTI looks to oil demand, data

Crude oil prices are exchanging gains with losses around the $37.00 mark per barrel and amidst a mild bias towards the risk complex on Friday. Prices seem to have met quite a decent contention in the $36.00 region so far following Tuesday’s sharp sell-off.

As usual since the start of the month, demand jitters continue to hurt the sentiment among traders, particularly in light of the strong pick-up in coronavirus cases around the world.

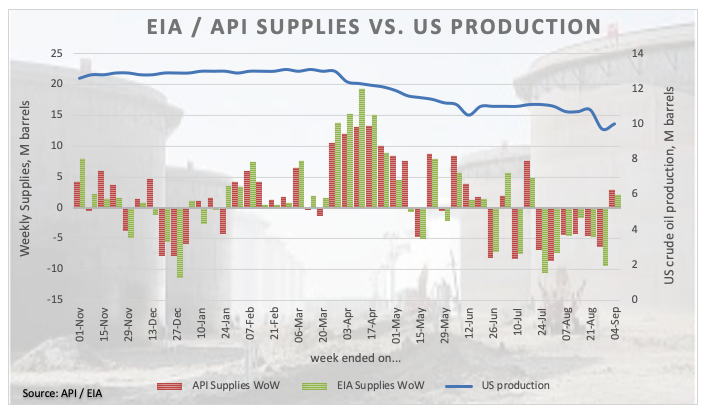

Adding to these concerns, worries from the supply side have started to gather traction after both the API and the EIA reported (on Wednesday and Thursday) unexpected builds in crude oil supplies during last week.

Later in the session, driller Baker Hughes will publish its weekly oil rig count.

WTI significant levels

At the moment the barrel of WTI is gaining 0.78% at $37.29 and faces the next hurdle at $40.67 (200-day SMA) seconded by $43.75 (monthly high Aug.26) and finally $48.64 (monthly high Mar.3). On the downside, a breach of $36.15 (monthly low Sep.8) would aim for $34.38 (low Jun.15) and finally $30.73 (low May 22).