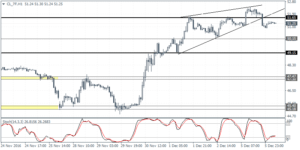

WTI Crude oil futures Intra-day Analysis

CLF (51.25): WTI Crude oil futures for January delivery closed bearish yesterday at $50.95. Oil futures are currently looking to retrace some of the declines from yesterday, but the gains could be capped near $51.65 which could act as resistance. Failure to post higher gains above $51.65 could signal potential downside in oil prices with the main support at $50.15 coming into focus. The bearish bias is also validated the rising wedge pattern coming near the top end of the short-term rally. Below 50.15, the next main support is seen at $49.15 which could be tested on a further decline.

EURGBP Intra-day Analysis

EURGBP (0.8442): EURGBP posted a reversal off the 0.8330 – 0.8246 support level yesterday. However, the level of retest at this support level was met with a strong rejection of prices indicating another firm retest to this support level. In the near term, EURGBP is likely to remain range bound within 0.8586 resistance and 0.8330 support. On the 4-hour chart, price action is currently looking to break out from the falling median line. The current pullback could, however, be limited to 0.8373 minor support, following which price could potentially rally towards 0.8586 resistance. To the downside, a break down below 0.8373 could see another retest to the previous support at 0.8330.

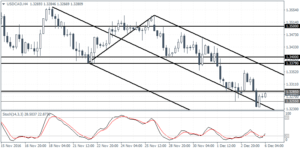

USDCAD Intra-day Analysis

USDCAD (1.3280): USDCAD fell to the main support near 1.3287 – 1.3255 and is looking to post a reversal at this level. A bullish close on the 4-hour chart above 1.3287 could signal further upside with the U.S. dollar pushing further ahead towards the next resistance level at 1.3379 – 1.3400 price zone. On the daily chart, the retest to 1.3300 – 1.3255 marks a retest of the major resistance level that was broken in late October. Establishing support here could signal further continuation to the upside with the previous high of 1.3565 likely to be challenged once again.