- Crude oil retreats further on Friday, challenges $58.00.

- The 10-day SMA around $58.40 holds the downside so far.

- Baker Hughes’ oil rig count coming up next.

Prices of the American reference for the sweet light crude oil are trading on the defensive for another session, so far finding support around the 10-day SMA near $58.40 per barrel.

WTI now looks to data

The barrel of WTI navigates the area of 2-day lows as the pick up in the demand for the greenback continues to weigh on traders’ sentiment.

Despite the continuation of the rejection from new 2019 highs at $60.00 recorded earlier in the week, prices of WTI remain on track to close the third consecutive week with gains.

Further out, rumours over the US-China trade dispute appears to be the main drivers of price action in the risk-associated complex for the time being.

In the data space, driller Baker Hughes will publish its usual weekly report on US oil rig count.

What to look for around WTI

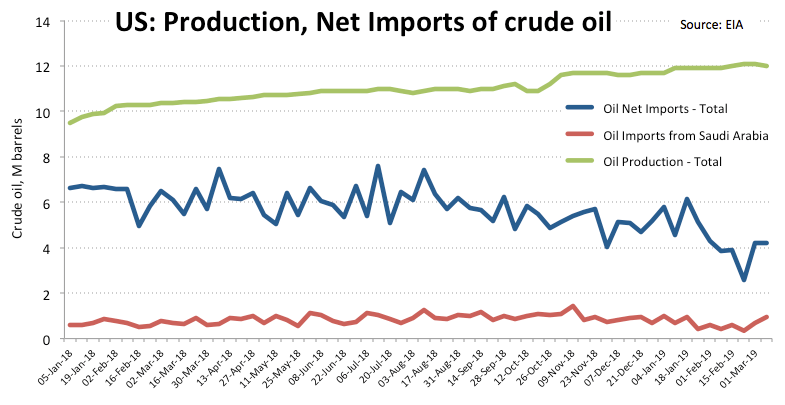

Crude oil has managed to retake the critical $60.00 mark per barrel on Thursday before sparking the ongoing correction lower. The bullish view in crude oil remains well in place, however, on the back of the so-called ‘Saudi put’, tight conditions in the US markets (amidst US net imports in historic low levels and the rising activity in refiners ahead of the summer session), the current OPEC+ agreement to cut oil output and ongoing US sanctions against Iranian and Venezuelan crude oil exports. Furthermore, the OPEC+ could announce an extension of the current agreement to curb oil production at the cartel’s meeting in June.

WTI significant levels

At the moment the barrel of WTI is losing 1.41% at $58.73 facing immediate contention at $58.33 (low Mar.22) seconded by $57.23 (21-day SMA) and finally $54.37 (low Mar.8). On the other hand, a breakout of $60.03 (2019 high Mar.21) would open the door for $61.84 (200-day SMA) and then $63.74 (61.8% Fibo of the October-December drop).