- Prices of the WTI remain on autopilot in the $41.00/$40.00 band.

- The EIA will report on US crude oil supplies later in the NA session.

- The FOMC meeting will be the salient event on Wednesday.

Prices of the American benchmark for the sweet light crude oil keep navigating within a tight range around the $41.00 mark per barrel.

WTI looks to data, pandemic

Crude oil prices keep the multi-week consolidation well in place on Wednesday amidst rising cautiousness among traders ahead of the key FOMC gathering later in the session.

As usual in past weeks, traders continue to gauge the ongoing re-opening of the global economy and its effects on the demand for the commodity, the OPEC+ plans to pump into the market around 2 million barrels/day starting in August and the unabated advance of the coronavirus pandemic and its potential impact on the industry.

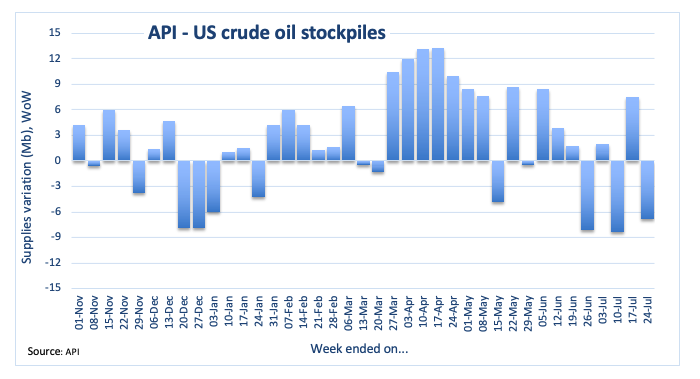

Late on Tuesday, the API reported US crude oil supplies shrunk by more than 6.8 million barrels during last week, exceeding initial estimates. Later on Wednesday it will be the EIA’s turn to report on crude oil inventories (+4.892 million prev.) ahead of the US oil rig count by driller Baker Hughes on Friday.

Also on the investors’ radar will be the key FOMC event, where the Fed could shed further light on the potential introduction to yield curve control (YCC) as well as a potential strengthening of the current forward guidance. Chief Powell’s press conference will also be closely followed, where the health of the US economy vs. the pandemic are seen on top of the agenda.

WTI significant levels

At the moment the barrel of WTI is gaining 0.40% at $41.30 and faces the next resistance at $43.09 (200-day SMA) seconded by $48.64 (monthly high Mar.3) and then $54.45 (monthly high Feb.20). On the downside, a breach of $38.56 (monthly low Jul.10) would aim for $37.94 (55-day SMA) and finally $34.38 (monthly low Jun.15).